Best Futures Prop Firms UK

We’ve tested every major futures prop firm that accepts UK traders and ranked them by challenge rules, payouts, support, and platforms. All firms below offer access to real CME markets and were scored using our in-house review system.

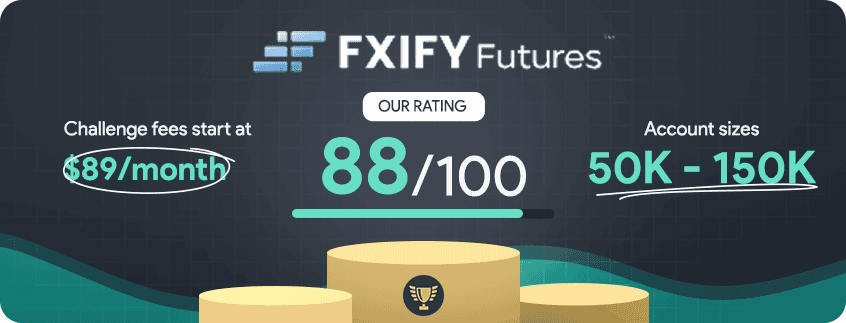

FXIFY Futures is our top-rated UK prop firm for 2026, scoring 88/100. It offers one-step evaluations with no time limits, high payout potential, and no recurring fees once funded. Profit splits scale up to 100%, and the built-in FFX platform includes TradingView charts and real-time CME data.

FXIFY Futures is our top-rated UK prop firm for 2026, scoring 88/100. It offers one-step evaluations with no time limits, high payout potential, and no recurring fees once funded. Profit splits scale up to 100%, and the built-in FFX platform includes TradingView charts and real-time CME data.

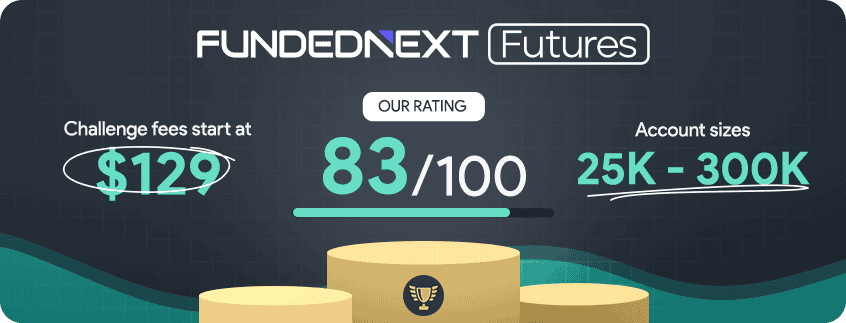

FundedNext Futures is the second-best futures prop firm in the UK, scoring 83/100 in our hands-on testing. It’s the futures division of FundedNext, now backed by its own brokerage, FNmarkets. You get a simple one-phase challenge with no time limits, real CME pricing, and zero activation or recurring fees. Once funded, you keep 100% of your profits and can withdraw every five days.

FundedNext Futures is the second-best futures prop firm in the UK, scoring 83/100 in our hands-on testing. It’s the futures division of FundedNext, now backed by its own brokerage, FNmarkets. You get a simple one-phase challenge with no time limits, real CME pricing, and zero activation or recurring fees. Once funded, you keep 100% of your profits and can withdraw every five days.

Ask an Expert