Best Prop Trading Platforms

Choosing the right prop firm often comes down to picking the platform you’re most comfortable trading on. Some traders want full MT4 or MT5 support for Expert Advisors, others prefer cTrader for depth-of-market tools, and many rely on TradingView for charting. We shortlist the best prop firm and platform combos.

FXIFY is the best MT5 prop firm because you can use the platform across every account type, including Instant Funding, and get access to one of the widest asset selections of any firm. MT5 gives you more control with advanced order types, a built-in economic calendar, and the ability to trade stocks and crypto in one place.

FXIFY is the best MT5 prop firm because you can use the platform across every account type, including Instant Funding, and get access to one of the widest asset selections of any firm. MT5 gives you more control with advanced order types, a built-in economic calendar, and the ability to trade stocks and crypto in one place.

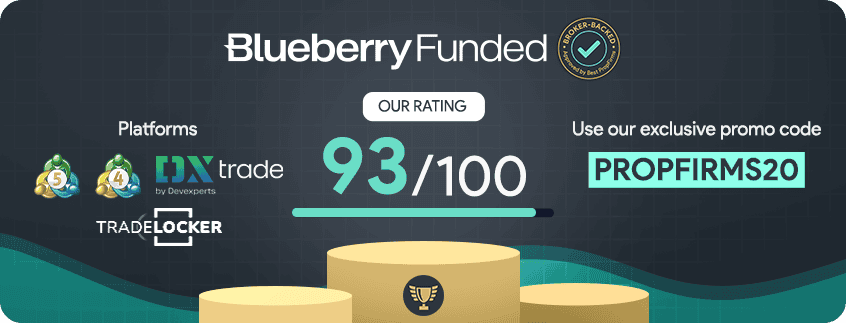

With an overall score of 93/100, Blueberry Funded is the best MT4 prop firm and 3rd on our list of the best prop trading platforms. The reputable prop firm offers full MT4 access across all challenge types, raw spreads from 0.1 pips, and seamless EA integration. It’s backed by ASIC-regulated Blueberry Markets and supports 1-click execution, chart templates, and automated strategies, making it ideal for scalpers, discretionary traders, and algo developers alike.

With an overall score of 93/100, Blueberry Funded is the best MT4 prop firm and 3rd on our list of the best prop trading platforms. The reputable prop firm offers full MT4 access across all challenge types, raw spreads from 0.1 pips, and seamless EA integration. It’s backed by ASIC-regulated Blueberry Markets and supports 1-click execution, chart templates, and automated strategies, making it ideal for scalpers, discretionary traders, and algo developers alike.

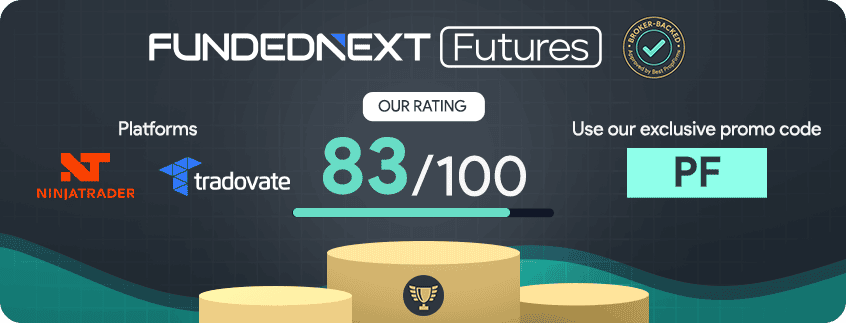

FundedNext Futures is the best prop firm for futures traders using Tradovate. It’s one of the few prop firms offering real CME market pricing with no activation fees, no recurring costs, and a full payout guarantee. You can trade mini and micro futures contracts across top markets like the S&P 500, Nasdaq, and Gold with direct access through Tradovate’s fast, browser-based platform.

FundedNext Futures is the best prop firm for futures traders using Tradovate. It’s one of the few prop firms offering real CME market pricing with no activation fees, no recurring costs, and a full payout guarantee. You can trade mini and micro futures contracts across top markets like the S&P 500, Nasdaq, and Gold with direct access through Tradovate’s fast, browser-based platform.

FundedNext is the best prop firm for TradingView users because it’s one of the only firms offering native integration with the charting platform through MT5. You can access advanced tools like custom scripts, economic overlays, and seamless chart-to-trade execution, all from your FundedNext dashboard. This makes it ideal for technical traders who rely on TradingView analysis but still want direct market access.

FundedNext is the best prop firm for TradingView users because it’s one of the only firms offering native integration with the charting platform through MT5. You can access advanced tools like custom scripts, economic overlays, and seamless chart-to-trade execution, all from your FundedNext dashboard. This makes it ideal for technical traders who rely on TradingView analysis but still want direct market access.

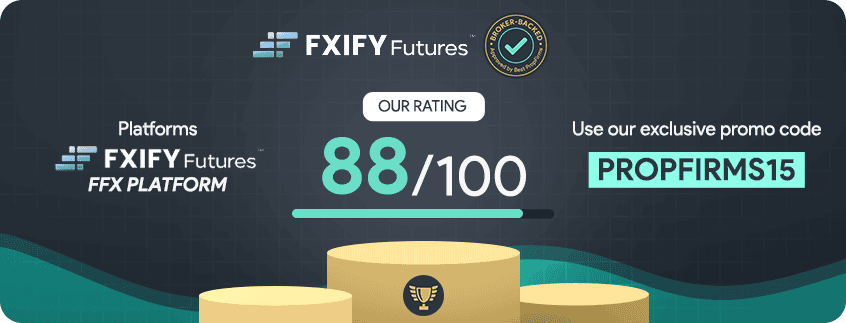

FXIFY Futures is the best prop firm for futures traders because it offers a purpose-built platform with TradingView charting, real-time CME data, and a clear payout structure that scales up to 100%. It’s one of the few futures firms that gives you unlimited trading days, a one-step evaluation, and transparent pricing with no hidden fees. If you’re serious about trading futures and want a clean, trader-first platform, FXIFY Futures delivers.

FXIFY Futures is the best prop firm for futures traders because it offers a purpose-built platform with TradingView charting, real-time CME data, and a clear payout structure that scales up to 100%. It’s one of the few futures firms that gives you unlimited trading days, a one-step evaluation, and transparent pricing with no hidden fees. If you’re serious about trading futures and want a clean, trader-first platform, FXIFY Futures delivers.