Best Futures Prop Firms

We tested 16 futures prop firms firsthand in 2026 and ranked them based on funding options, profit splits, evaluation rules, and trading platform access. This shortlist of the 10 best futures prop firms looks at how each one scored and what you can expect in terms of trading conditions, fees, and payout models.

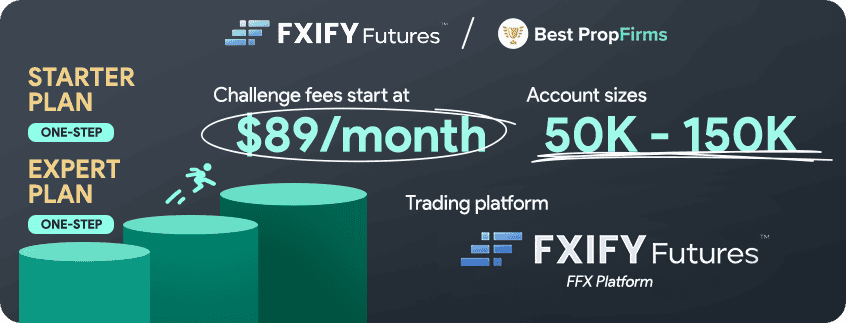

FXIFY Futures is the best futures prop firm we reviewed with an overall score of 88/100. You go through a one step evaluation process to receive a funded account with up to 100% profit split. You also get access to real-time CME data with TradingView charts.

FXIFY Futures is the best futures prop firm we reviewed with an overall score of 88/100. You go through a one step evaluation process to receive a funded account with up to 100% profit split. You also get access to real-time CME data with TradingView charts.

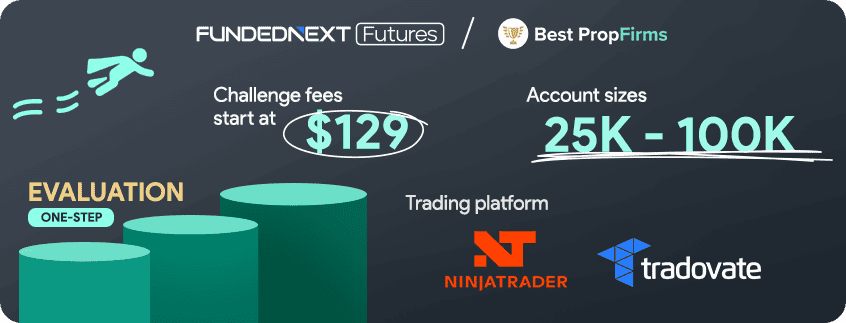

FundedNext Futures is the best prop firm for fast payouts and simple evaluations. You keep 100% of your profits after passing a one step challenge with no time limit, real CME pricing, and no activation or monthly fees. One of the biggest perks is FundedNext offers a $1,000 payout guarantee if they miss their 24-hour withdrawal promise, which isn’t a common promise in the prop trading industry.

FundedNext Futures is the best prop firm for fast payouts and simple evaluations. You keep 100% of your profits after passing a one step challenge with no time limit, real CME pricing, and no activation or monthly fees. One of the biggest perks is FundedNext offers a $1,000 payout guarantee if they miss their 24-hour withdrawal promise, which isn’t a common promise in the prop trading industry.