Best Crypto Prop Firms

We’ve shortlisted the 10 best crypto prop firms, comparing key features like challenge types, audition fees, financial instruments, and trading costs. Our guide will help you find the prop firm and challenge best suited to your cryptocurrency trading style.

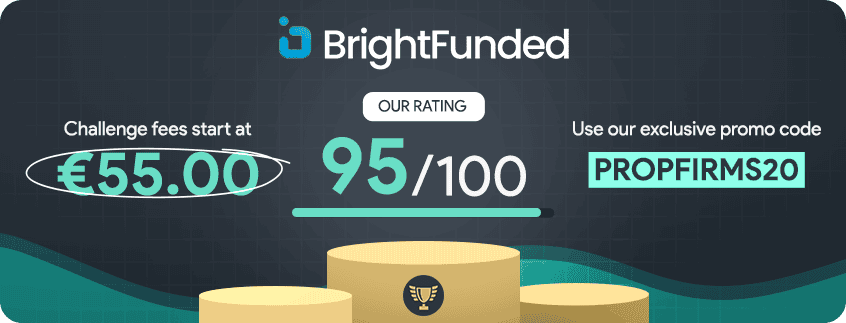

We’ve ranked BrightFunded as the best crypto prop firm thanks to a 95/100 overall score, dozens of cryptocurrency pairs with 5:1 leverage, and a load of addons to tailor your funded account. You get more than just the major cryptos like Bitcoin and Ethereum and can trade altcoins and meme coins as well. One of the major perks is that every time you trade, regardless of whether it’s successful or not, you earn tokens through their loyalty program that you can redeem for free challenges, better trading conditions, and various other benefits.

We’ve ranked BrightFunded as the best crypto prop firm thanks to a 95/100 overall score, dozens of cryptocurrency pairs with 5:1 leverage, and a load of addons to tailor your funded account. You get more than just the major cryptos like Bitcoin and Ethereum and can trade altcoins and meme coins as well. One of the major perks is that every time you trade, regardless of whether it’s successful or not, you earn tokens through their loyalty program that you can redeem for free challenges, better trading conditions, and various other benefits.

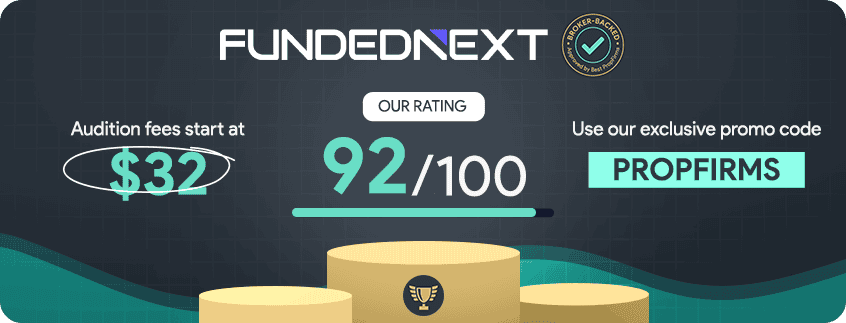

FundedNext is a great option if you want zero-commission crypto trading, profit splits up to 95%, and access to multiple trading platforms like MT4, MT5, and cTrader. Payouts are processed every two weeks, keeping withdrawals consistent.

FundedNext is a great option if you want zero-commission crypto trading, profit splits up to 95%, and access to multiple trading platforms like MT4, MT5, and cTrader. Payouts are processed every two weeks, keeping withdrawals consistent.

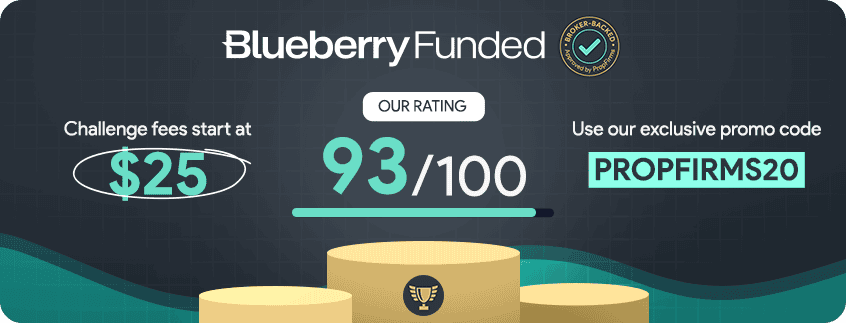

Blueberry Funded is a strong option if you want EA-friendly crypto trading with 24/7 access and low fees starting from $32.50. With four challenge types and support for 52 crypto markets, you can choose between structured or rapid evaluations to match your trading pace.

Blueberry Funded is a strong option if you want EA-friendly crypto trading with 24/7 access and low fees starting from $32.50. With four challenge types and support for 52 crypto markets, you can choose between structured or rapid evaluations to match your trading pace.

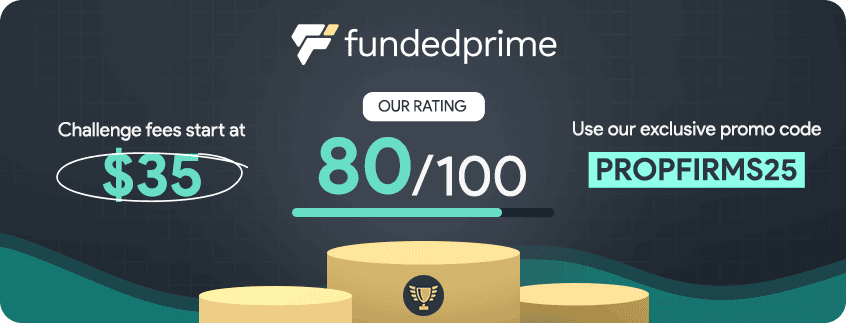

If you want crypto plus something a bit different, Funded Prime is worth a look. You get standard crypto pairs in the regular one and two step challenges, and a separate Meme Coin Challenge where tokens like PEPE, WIF, and TRUMP run at 10:1 leverage with no exchange or wallet setup. Pricing tracks Eightcap’s live feed (a top forex broker). EAs are allowed on all challenges and payouts are fast, so you can test both systematic and discretionary ideas without juggling prop firms.

If you want crypto plus something a bit different, Funded Prime is worth a look. You get standard crypto pairs in the regular one and two step challenges, and a separate Meme Coin Challenge where tokens like PEPE, WIF, and TRUMP run at 10:1 leverage with no exchange or wallet setup. Pricing tracks Eightcap’s live feed (a top forex broker). EAs are allowed on all challenges and payouts are fast, so you can test both systematic and discretionary ideas without juggling prop firms.