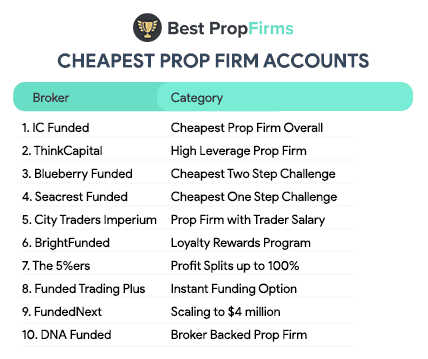

Cheapest Prop Firm Accounts

We compared the best prop firms to find the most affordable options based on 100K two-step challenge fees. Our rankings of the cheapest prop trading firms focus on those that offer the lowest entry costs while maintaining trader-friendly conditions, high profit splits, and flexible payout structures.

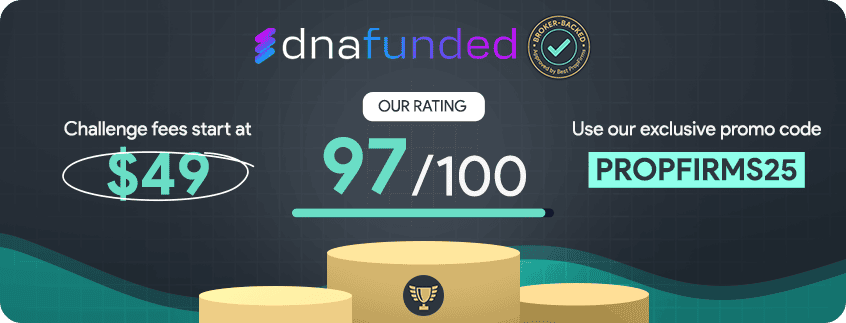

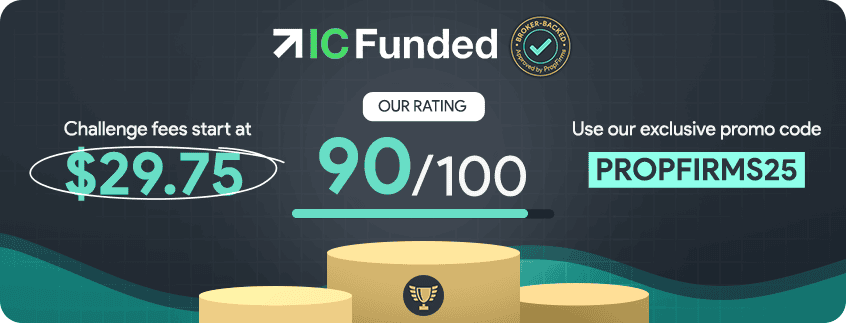

Amongst all the reputable prop firms we’ve tested, IC Funded has the cheapest fees and best trading conditions. With the PROPFIRMS25 promo code challenge fees start at just $37, making it the cheapest funded account.

Amongst all the reputable prop firms we’ve tested, IC Funded has the cheapest fees and best trading conditions. With the PROPFIRMS25 promo code challenge fees start at just $37, making it the cheapest funded account.

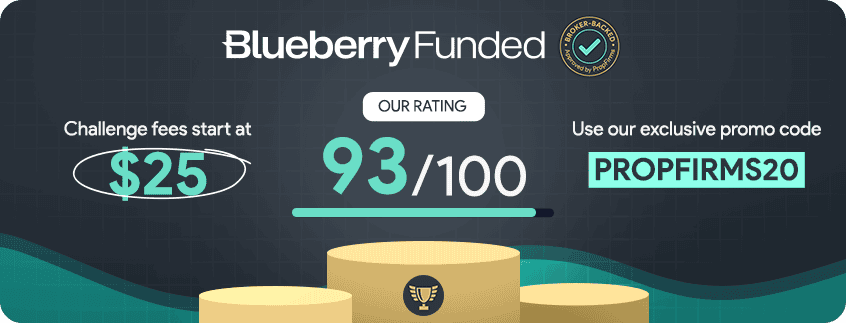

Blueberry Funded offers some of the lowest-cost prop challenges, starting from $32.50, with the 100K two-step challenge priced at just $500. The prop firm scored 93/100 overall, ranking 3rd on our list of the cheapest prop firms.

Blueberry Funded offers some of the lowest-cost prop challenges, starting from $32.50, with the 100K two-step challenge priced at just $500. The prop firm scored 93/100 overall, ranking 3rd on our list of the cheapest prop firms.

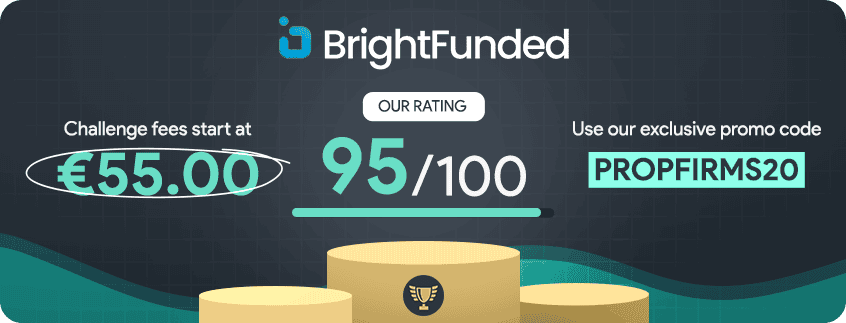

BrightFunded is popular thanks to its great Trade2Earn loyalty program, rewarding you for your trading activity regardless of the outcomes. They also offer unlimited scaling with high profit splits, allowing you to grow your account over time. Use the exclusive promo code PROPFIRMS20 for a 20% discount on your challenge fees.

BrightFunded is popular thanks to its great Trade2Earn loyalty program, rewarding you for your trading activity regardless of the outcomes. They also offer unlimited scaling with high profit splits, allowing you to grow your account over time. Use the exclusive promo code PROPFIRMS20 for a 20% discount on your challenge fees.