Best Prop Firms in Canada

Our list of the best prop firms in Canada offer a range of popular features like low fee challenges, high profit splits, scaling plans, instant funding, and more. To determine which prop firms are best for Canadian traders, we opened challenge accounts with each to test their trading conditions and platforms.

We’ve ranked BrightFunded the best prop trading firm for Canadian traders because our researchers cant find another that competes with its customisable challenges, Trade2Earn loyalty program, and unlimited scaling plan. You can pick from various account sizes up to $200K but its not overcomplicated with too many challenges options. You can also tailor your account with different add-ons, such as faster payouts and higher profit splits.

We’ve ranked BrightFunded the best prop trading firm for Canadian traders because our researchers cant find another that competes with its customisable challenges, Trade2Earn loyalty program, and unlimited scaling plan. You can pick from various account sizes up to $200K but its not overcomplicated with too many challenges options. You can also tailor your account with different add-ons, such as faster payouts and higher profit splits.

OANDA Prop Trader, the prop trading branch of the popular OANDA brand, is one of the cheapest prop firms with a simple set up for beginners. You can choose between two challenge models, Boost or Classic, and account sizes up to $500,000. Both models involve a two step evaluation before receiving your funded account, and all trading is via MetaTrader 5.

OANDA Prop Trader, the prop trading branch of the popular OANDA brand, is one of the cheapest prop firms with a simple set up for beginners. You can choose between two challenge models, Boost or Classic, and account sizes up to $500,000. Both models involve a two step evaluation before receiving your funded account, and all trading is via MetaTrader 5.

DNA Funded is a broker-backed prop firm from Australia that is popular among the more experienced prop traders thanks to its tight spreads, fast execution, and low challenge fees. One of the biggest perks is its huge product range with over 800 markets. You also get a great bunch of add-ons to tailor your funded account, and profit splits up to 90%.

DNA Funded is a broker-backed prop firm from Australia that is popular among the more experienced prop traders thanks to its tight spreads, fast execution, and low challenge fees. One of the biggest perks is its huge product range with over 800 markets. You also get a great bunch of add-ons to tailor your funded account, and profit splits up to 90%.

FundedNext is a great pick for Canadian traders who want choice in how they get funded. You can go for a one-step challenge with fast payouts or choose a two-step option with cheaper fees. Both offer up to 95% profit splits, with classic Stellar Models also receiving a 15% profit share during the evaluation phase.

FundedNext is a great pick for Canadian traders who want choice in how they get funded. You can go for a one-step challenge with fast payouts or choose a two-step option with cheaper fees. Both offer up to 95% profit splits, with classic Stellar Models also receiving a 15% profit share during the evaluation phase.

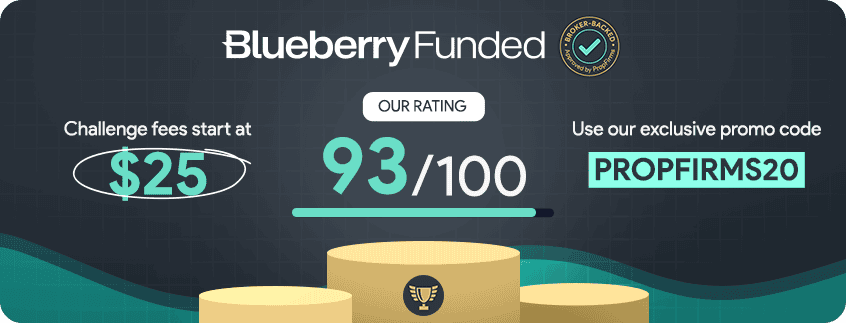

Blueberry Funded is one of the highest-rated prop firms in Canada, offering four structured challenges from just $32.50. You can trade over 1,100 instruments, including forex, crypto, and stocks, with leverage up to 1:50 and payouts every 14 days. It’s also the best stock prop firm in this list, thanks to its dedicated Stock Challenge for equity traders.

Blueberry Funded is one of the highest-rated prop firms in Canada, offering four structured challenges from just $32.50. You can trade over 1,100 instruments, including forex, crypto, and stocks, with leverage up to 1:50 and payouts every 14 days. It’s also the best stock prop firm in this list, thanks to its dedicated Stock Challenge for equity traders.