Trade the Pool Review

Trade The Pool is a US stock prop firm offering access to 12,000+ real equities and ETFs using exchange data from Nasdaq, NYSE and CBOE. It scored 70/100 in testing thanks to clear rules and deep market coverage, but its strict volume limits and lack of automation during the evaluation won’t suit everyone or style.

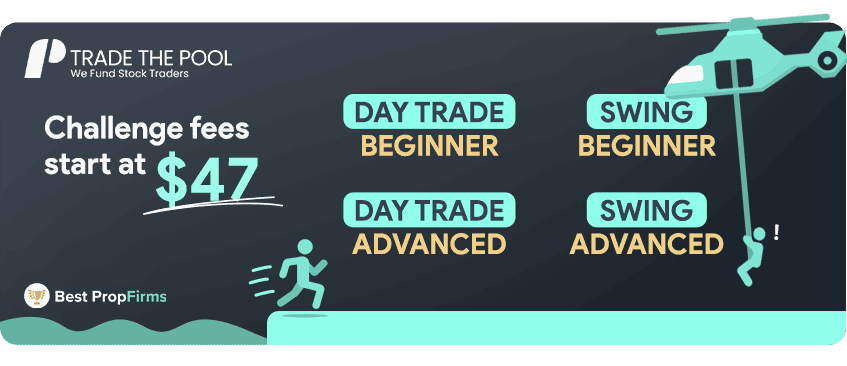

The Day Trade Beginner program is the most flexible option in TTP’s day-trading lineup. Every account size follows the same rules, so all you focus on is reaching the profit target while staying inside the built-in risk limits.

The Day Trade Beginner program is the most flexible option in TTP’s day-trading lineup. Every account size follows the same rules, so all you focus on is reaching the profit target while staying inside the built-in risk limits. The Day Trade Advanced program is better if you want a more structured evaluation with tighter risk limits and a higher activity requirement. It runs on the same single-phase layout as the Beginner version but demands more consistency across trades, which makes it better suited to active intraday traders who place frequent positions and can manage risk day-to-day.

The Day Trade Advanced program is better if you want a more structured evaluation with tighter risk limits and a higher activity requirement. It runs on the same single-phase layout as the Beginner version but demands more consistency across trades, which makes it better suited to active intraday traders who place frequent positions and can manage risk day-to-day. The Swing Beginner program is ideal for traders who hold positions longer and need the space to manage multi-day moves.

The Swing Beginner program is ideal for traders who hold positions longer and need the space to manage multi-day moves. The Swing Advanced program keeps the same higher target and wider risk limits as Swing Beginner but introduces a 100-day deadline.

The Swing Advanced program keeps the same higher target and wider risk limits as Swing Beginner but introduces a 100-day deadline. Challenges score 8/10 because Trade The Pool’s one step challenge, modest targets on day accounts and clear drawdown rules make the trading programs straightforward to navigate. You get a choice between day and swing models, unlimited time on the beginner tiers and multiple account sizes, which keeps the entry barrier reasonable. The score isn’t higher because the consistency rule and volume caps introduce extra limitations that can make certain strategies harder to execute cleanly.

Challenges score 8/10 because Trade The Pool’s one step challenge, modest targets on day accounts and clear drawdown rules make the trading programs straightforward to navigate. You get a choice between day and swing models, unlimited time on the beginner tiers and multiple account sizes, which keeps the entry barrier reasonable. The score isn’t higher because the consistency rule and volume caps introduce extra limitations that can make certain strategies harder to execute cleanly.

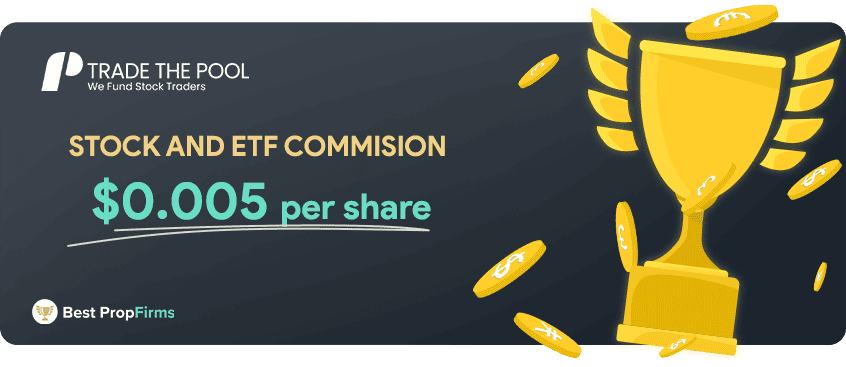

Spreads and trading fees score 7/10 because Trade The Pool uses real exchange data from Nasdaq, NYSE and CBOE, giving you accurate pricing and no hidden mark-ups. The per-share commission is transparent and fair for normal position sizes, and there are no extra platform or data fees added on top. The score doesn’t go higher because the $0.005 per-share model becomes expensive for high-volume traders, and large share counts can make costs stack up faster than at CFD-style props with capped or all-in fees.

Spreads and trading fees score 7/10 because Trade The Pool uses real exchange data from Nasdaq, NYSE and CBOE, giving you accurate pricing and no hidden mark-ups. The per-share commission is transparent and fair for normal position sizes, and there are no extra platform or data fees added on top. The score doesn’t go higher because the $0.005 per-share model becomes expensive for high-volume traders, and large share counts can make costs stack up faster than at CFD-style props with capped or all-in fees.

Markets score 8/10 because Trade The Pool offers one of the largest stock and ETF selections available, with 12,000+ US-listed symbols covering large caps, small caps, penny stocks and every major sector. Extended-hours access and overnight holding on swing accounts make it flexible for multiple strategies. It doesn’t earn a higher score because everything is limited to US equities only, with no forex, crypto, indices or futures, which reduces appeal for multi-asset traders.

Markets score 8/10 because Trade The Pool offers one of the largest stock and ETF selections available, with 12,000+ US-listed symbols covering large caps, small caps, penny stocks and every major sector. Extended-hours access and overnight holding on swing accounts make it flexible for multiple strategies. It doesn’t earn a higher score because everything is limited to US equities only, with no forex, crypto, indices or futures, which reduces appeal for multi-asset traders.

Platforms score 6/10 because TraderEvolution provides strong stock trading tools like Level 2, hotkeys, ladder trading and advanced order types, giving manual equity traders everything they need to operate efficiently. The drawback is that it’s the only platform available, with no support for MT4/MT5, cTrader, TradingView or third-party terminals. Automation is also blocked during evaluations, so algorithmic or multi-platform traders will find the setup restrictive.

Platforms score 6/10 because TraderEvolution provides strong stock trading tools like Level 2, hotkeys, ladder trading and advanced order types, giving manual equity traders everything they need to operate efficiently. The drawback is that it’s the only platform available, with no support for MT4/MT5, cTrader, TradingView or third-party terminals. Automation is also blocked during evaluations, so algorithmic or multi-platform traders will find the setup restrictive.

Payouts score 6/10 because the 14 day payout cycle, $300 minimum and 70% split are all standard for US-stock prop firms, and the process is generally reliable once the account passes a quick risk review. The score isn’t higher because the withdrawal minimum is relatively high, challenge fees aren’t refunded, and some payout methods may include processing fees. It’s a functional system, just not one of the more generous payout structures on the market.

Payouts score 6/10 because the 14 day payout cycle, $300 minimum and 70% split are all standard for US-stock prop firms, and the process is generally reliable once the account passes a quick risk review. The score isn’t higher because the withdrawal minimum is relatively high, challenge fees aren’t refunded, and some payout methods may include processing fees. It’s a functional system, just not one of the more generous payout structures on the market. Support and education score 6/10 because Trade The Pool covers the basics well with email support, FAQs and platform guides, but doesn’t go much beyond that. Response times are reasonable for a stock-focused firm, and the Trader’s Area plus Program Terms do a solid job of explaining platform use and risk rules. However, there’s no 24/7 live chat, no large in-house community like Discord, and educational content is fairly light, so traders who want coaching, webinars or very hands-on support will need to look elsewhere.

Support and education score 6/10 because Trade The Pool covers the basics well with email support, FAQs and platform guides, but doesn’t go much beyond that. Response times are reasonable for a stock-focused firm, and the Trader’s Area plus Program Terms do a solid job of explaining platform use and risk rules. However, there’s no 24/7 live chat, no large in-house community like Discord, and educational content is fairly light, so traders who want coaching, webinars or very hands-on support will need to look elsewhere.

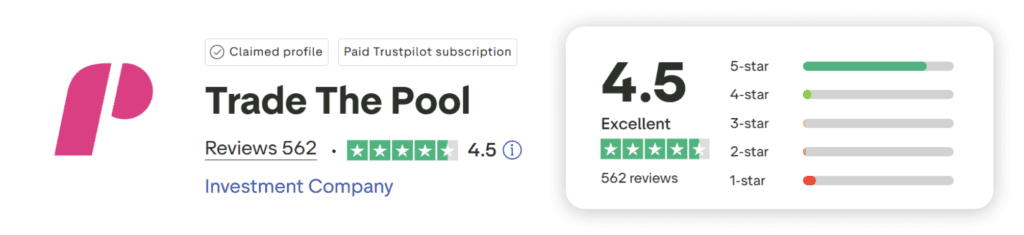

Trust and transparency scores 7/10 because Trade The Pool provides clear rules, full program terms, and real exchange data from Nasdaq, NYSE and CBOE. Its association with Five Percent Online Ltd (The 5%ers) and a strong Trustpilot rating help reinforce credibility. It doesn’t score higher because trading is entirely simulated with no regulated broker backing, automation restrictions still apply, and some users report slower response times or confusion around certain rules.

Trust and transparency scores 7/10 because Trade The Pool provides clear rules, full program terms, and real exchange data from Nasdaq, NYSE and CBOE. Its association with Five Percent Online Ltd (The 5%ers) and a strong Trustpilot rating help reinforce credibility. It doesn’t score higher because trading is entirely simulated with no regulated broker backing, automation restrictions still apply, and some users report slower response times or confusion around certain rules.