Maven Trading Review

Based on our testing, Maven Trading achieved a score of 62/100 because of wider spreads and poor transparency around pricing. Although the prop firm offers multiple challenges with low fees and instant funding accounts, Maven Trading has restrictive payouts and unhelpful customer support.

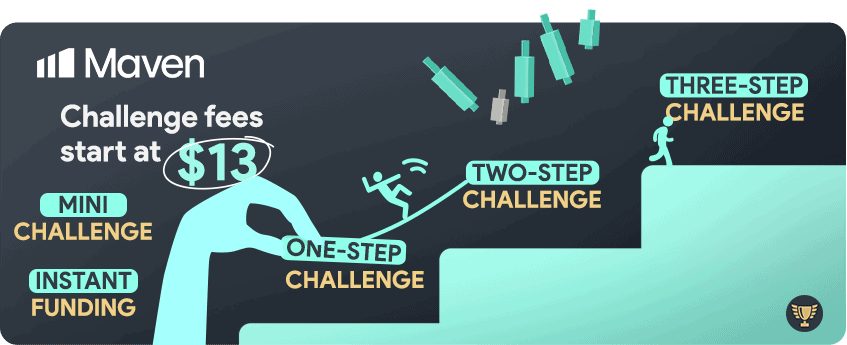

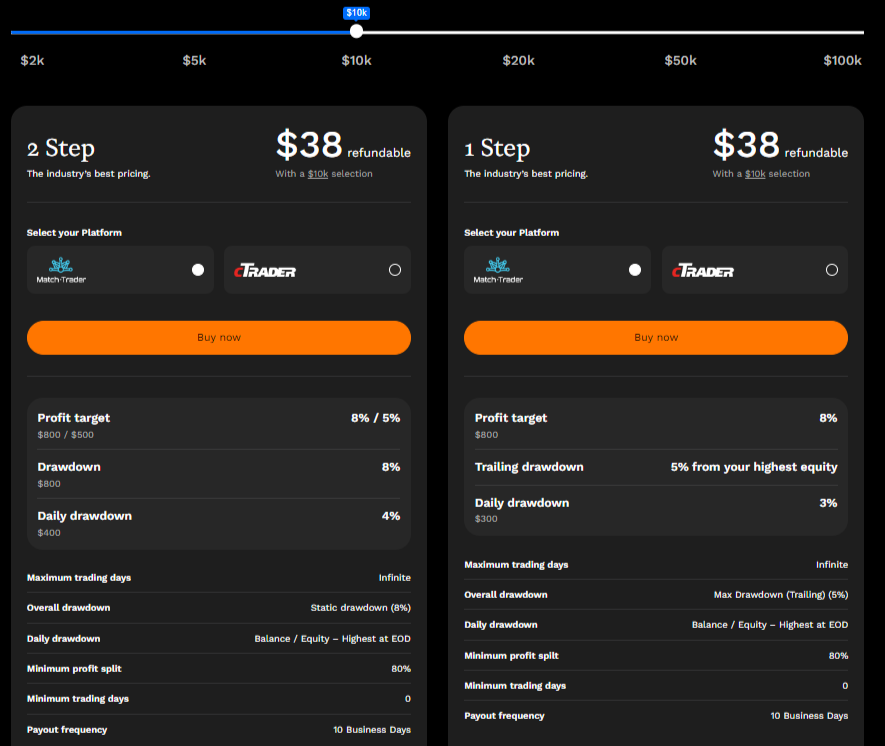

The One-Step challenge is great if you have solid trading experience, and the confidence to nail it in a single, straightforward evaluation phase. This challenge requires you to hit an 8% profit target with a 5% trailing drawdown. The trailing drawdown adjusts based on your highest equity, meaning as your account grows, the drawdown limit follows. The daily drawdown is limited to 3% which makes your risk management more stringent, but you have unlimited time to meet your target.

The One-Step challenge is great if you have solid trading experience, and the confidence to nail it in a single, straightforward evaluation phase. This challenge requires you to hit an 8% profit target with a 5% trailing drawdown. The trailing drawdown adjusts based on your highest equity, meaning as your account grows, the drawdown limit follows. The daily drawdown is limited to 3% which makes your risk management more stringent, but you have unlimited time to meet your target.

The Three-Step challenge is the most gradual of all the challenges. You’ll need to complete three phases, each with a 3% profit target. There’s a 2% daily drawdown loss, but there’s no timeframe, and the fees are low which allows for a stress-free trading.

The Three-Step challenge is the most gradual of all the challenges. You’ll need to complete three phases, each with a 3% profit target. There’s a 2% daily drawdown loss, but there’s no timeframe, and the fees are low which allows for a stress-free trading. The Instant Funding challenge allows you to skip the multi-step challenge phase, and immediately begin with a funded account. The catch is that you take on a trailing 3% total drawdown and a daily loss limit of 2% applied at the start of each day. Before you can request a payout, the minimum withdrawal threshold is set at 3% profit of the account.

The Instant Funding challenge allows you to skip the multi-step challenge phase, and immediately begin with a funded account. The catch is that you take on a trailing 3% total drawdown and a daily loss limit of 2% applied at the start of each day. Before you can request a payout, the minimum withdrawal threshold is set at 3% profit of the account. The Mini Challenge is a fast-paced, low initial commitment option specifically designed if you want something more flexible with barely any waiting period. It’s a short-duration challenge with a daily 2% drawdown limit, in which you have to achieve a minimum 3% profit to request your payout, but you can only hold one open trade at a time.

The Mini Challenge is a fast-paced, low initial commitment option specifically designed if you want something more flexible with barely any waiting period. It’s a short-duration challenge with a daily 2% drawdown limit, in which you have to achieve a minimum 3% profit to request your payout, but you can only hold one open trade at a time.