Instant Funding Review

We gave Instant Funding a 58/100 score because it’s an independent prop trading firm suited for those looking for instant funding choices with no evaluation at all. While they have transparent rules and a number of challenges with addons, their spreads are not disclosed and they have a reputation for not honoring their guidelines.

The Instant Funding account is the flagship program that provides immediate access to a funded account from $625 up to $120,000 without evaluation, no minimum trading days, an 80-90% profit share, and one-off fee ranging from $44 and onward.

The Instant Funding account is the flagship program that provides immediate access to a funded account from $625 up to $120,000 without evaluation, no minimum trading days, an 80-90% profit share, and one-off fee ranging from $44 and onward. Contrary to the name, the Instant Funding Micro accounts are bigger versions of the main instant funding model with $5,000 up to $300,000, no minimum or maximum trading days, a 4% daily drawdown, and 6% static drawdown of your starting balance.

Contrary to the name, the Instant Funding Micro accounts are bigger versions of the main instant funding model with $5,000 up to $300,000, no minimum or maximum trading days, a 4% daily drawdown, and 6% static drawdown of your starting balance. IF just rolled out the new account ‘IF1’ which is a unique, non-scaling, high-risk high-reward instant funding model designed for short term trading with a strict 24-hour time limit from the first trade. You also get a 90% profit split, a very tight 4% maximum drawdown, a 2% daily loss, and account sizes between $2K and $200K.

IF just rolled out the new account ‘IF1’ which is a unique, non-scaling, high-risk high-reward instant funding model designed for short term trading with a strict 24-hour time limit from the first trade. You also get a 90% profit split, a very tight 4% maximum drawdown, a 2% daily loss, and account sizes between $2K and $200K. The One Step Challenge is a single step evaluation account with $5,000 to $200,000 account sizes, and a 10% profit target from the starting balance that allows you to trade at your own pace.

The One Step Challenge is a single step evaluation account with $5,000 to $200,000 account sizes, and a 10% profit target from the starting balance that allows you to trade at your own pace. The One Step Micro Challenge variant has a simpler 8% profit target to reach funded status, but you’ll have to have a minimum of 3 separate trading days before passing.

The One Step Micro Challenge variant has a simpler 8% profit target to reach funded status, but you’ll have to have a minimum of 3 separate trading days before passing. The Two Step Challenge is a standard two step evaluation model offered in account sizes ranging from $5,000 up to $200,000, account size scaling, 5% Daily Loss and 10% Static Maximum Drawdown. Once funded, you’re eligible for payouts after achieving 1.5% net profit, with the strict rule to a 40% consistency rule on the best trading day.

The Two Step Challenge is a standard two step evaluation model offered in account sizes ranging from $5,000 up to $200,000, account size scaling, 5% Daily Loss and 10% Static Maximum Drawdown. Once funded, you’re eligible for payouts after achieving 1.5% net profit, with the strict rule to a 40% consistency rule on the best trading day. The Two Step Max Challenge is an advanced two step evaluation ranging from $5,000 up to $200,000, and profit targets set at 8% for Step 1 and 4% in Step 2, with a minimum of three trading days, and no maximum time limit.

The Two Step Max Challenge is an advanced two step evaluation ranging from $5,000 up to $200,000, and profit targets set at 8% for Step 1 and 4% in Step 2, with a minimum of three trading days, and no maximum time limit. The challenge segment scored 6/10 due to their moderately decent fees, but the need for an add-on to lower the 10% drawdown to an 8% loss the prop firm points here. For most, the profit targets are at an acceptable range.

The challenge segment scored 6/10 due to their moderately decent fees, but the need for an add-on to lower the 10% drawdown to an 8% loss the prop firm points here. For most, the profit targets are at an acceptable range.

We give this segment a 3/10. Instant Funding’s fee structure is simple, with no recurring subscriptions mentioned. However, their non-disclosed execution model and spread structure are red flags that definitely reduce pre-purchase transparency, despite stating they mirror real-market conditions.

We give this segment a 3/10. Instant Funding’s fee structure is simple, with no recurring subscriptions mentioned. However, their non-disclosed execution model and spread structure are red flags that definitely reduce pre-purchase transparency, despite stating they mirror real-market conditions.

Instant Funding scores a 7/10 for their decent size market and leverage that goes up to 1:100. They have access to standard forex, indices, and crypto assets, but options, ETFs, stocks, bonds, and futures are not offered by the prop firm.

Instant Funding scores a 7/10 for their decent size market and leverage that goes up to 1:100. They have access to standard forex, indices, and crypto assets, but options, ETFs, stocks, bonds, and futures are not offered by the prop firm.

We scored Instant Funding’s platforms 8/10, thanks to them offering three popular platforms across all challenges and accounts. I didn’t run into any major problems when testing the charting, automation, and risk management tools on cTrader and Match-Trader, aside from the occasional lags.

We scored Instant Funding’s platforms 8/10, thanks to them offering three popular platforms across all challenges and accounts. I didn’t run into any major problems when testing the charting, automation, and risk management tools on cTrader and Match-Trader, aside from the occasional lags.

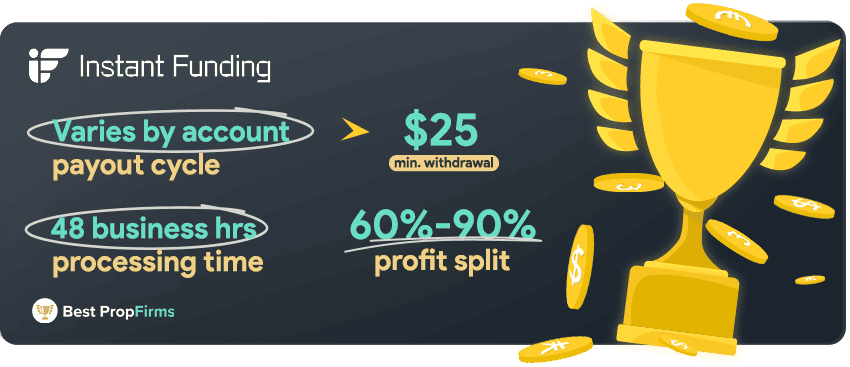

We give Instant Funding a 8/10 because the payout rules vastly differ by account type as some are On-Demand, weekly, or bi-weekly, but all of them can be topped up to 90% profit share via addon. While there’s a $25 minimum withdrawal amount, there are many different payment services, no recurring fees, and quick processing that also positively affect the score.

We give Instant Funding a 8/10 because the payout rules vastly differ by account type as some are On-Demand, weekly, or bi-weekly, but all of them can be topped up to 90% profit share via addon. While there’s a $25 minimum withdrawal amount, there are many different payment services, no recurring fees, and quick processing that also positively affect the score. Both Instant Funding’s 24/7 live chat and email support was fast and responsive, even though phone support is lacking. Their educational resources are strictly self-service documentation, but the lack of online tutorials and courses slightly lower the score at 7/10.

Both Instant Funding’s 24/7 live chat and email support was fast and responsive, even though phone support is lacking. Their educational resources are strictly self-service documentation, but the lack of online tutorials and courses slightly lower the score at 7/10.

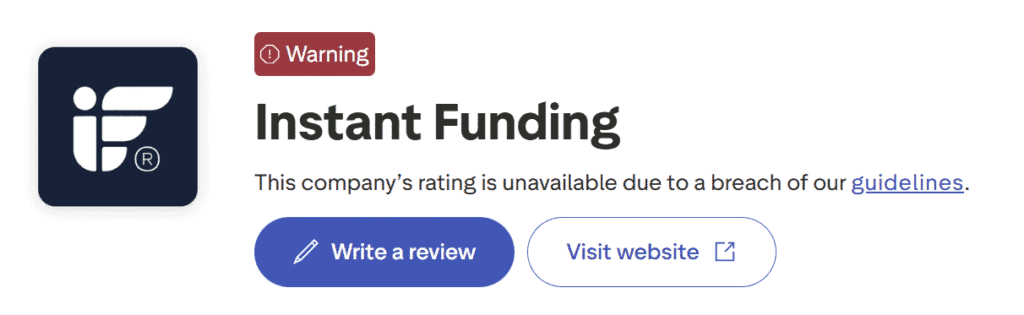

We gave IF a score of 3/10 on Transparency and Trust mainly because of their TrustPilot review removal due to fake review allegations. While they have a very active Discord social channel for an independent prop firm, there’s a large number of prop traders complaining about denied payout requests and mishandling of disputes which drastically lowers their reputation.

We gave IF a score of 3/10 on Transparency and Trust mainly because of their TrustPilot review removal due to fake review allegations. While they have a very active Discord social channel for an independent prop firm, there’s a large number of prop traders complaining about denied payout requests and mishandling of disputes which drastically lowers their reputation.