Goat Funded Trader Review

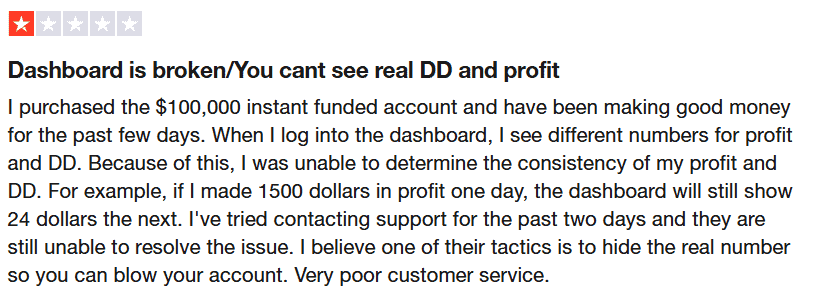

Goat Funded Trader offers flexible challenges and instant funding, but lack of transparency on spreads, leverage, and profit payouts raised concerns during testing, resulting in a low score of 42/100. While some prop traders succeed, others report payout delays and unclear rules—proceed with caution.

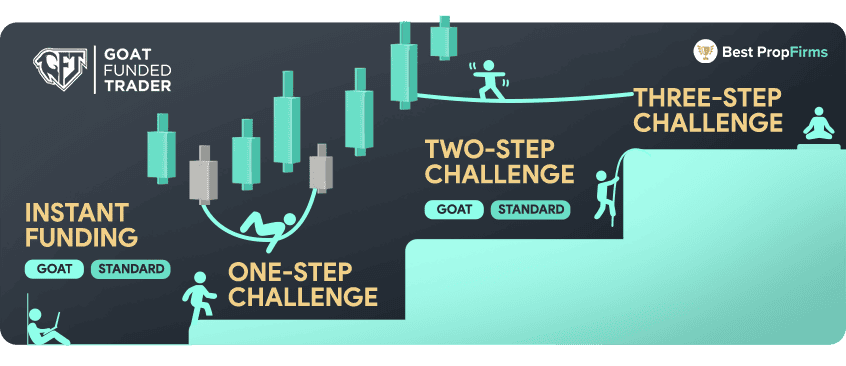

The One-Step Challenge requires traders to achieve a 10% profit target in a single phase while staying within a 4% daily drawdown and a 6% maximum drawdown. Unlike two-step models, traders do not need to pass a second verification stage before receiving a funded account.

The One-Step Challenge requires traders to achieve a 10% profit target in a single phase while staying within a 4% daily drawdown and a 6% maximum drawdown. Unlike two-step models, traders do not need to pass a second verification stage before receiving a funded account. The Two-Step Challenge splits the evaluation into two stages, with a profit target of 8-10% in Step 1 and a lower 5-6% target in Step 2. You must also adhere to a 4-5% daily drawdown and a maximum drawdown of 10%.

The Two-Step Challenge splits the evaluation into two stages, with a profit target of 8-10% in Step 1 and a lower 5-6% target in Step 2. You must also adhere to a 4-5% daily drawdown and a maximum drawdown of 10%. The Three-Step Challenge is a slower, more incremental approach to evaluation. Each phase requires you to reach a 6% profit target while staying within an 8% maximum drawdown. The structure is designed to filter out high-risk trading strategies, favoring those who maintain steady and controlled performance.

The Three-Step Challenge is a slower, more incremental approach to evaluation. Each phase requires you to reach a 6% profit target while staying within an 8% maximum drawdown. The structure is designed to filter out high-risk trading strategies, favoring those who maintain steady and controlled performance. Goat Funded Trader’s Instant Funding accounts allow you to start with live capital without completing an evaluation. These accounts have no profit targets, but they come with stricter risk rules, including a 3-4% daily drawdown limit and a 6-8% maximum drawdown.

Goat Funded Trader’s Instant Funding accounts allow you to start with live capital without completing an evaluation. These accounts have no profit targets, but they come with stricter risk rules, including a 3-4% daily drawdown limit and a 6-8% maximum drawdown.