Funded Elite Review

Funded Elite scores 62/100 in our review, thanks to its highly customisable challenge options and wide CFD market access, offset by strict risk rules and mixed payout feedback. It’s an option if you want flexible one step, two step, or instant funding accounts, and are comfortable managing tight drawdown and consistency limits.

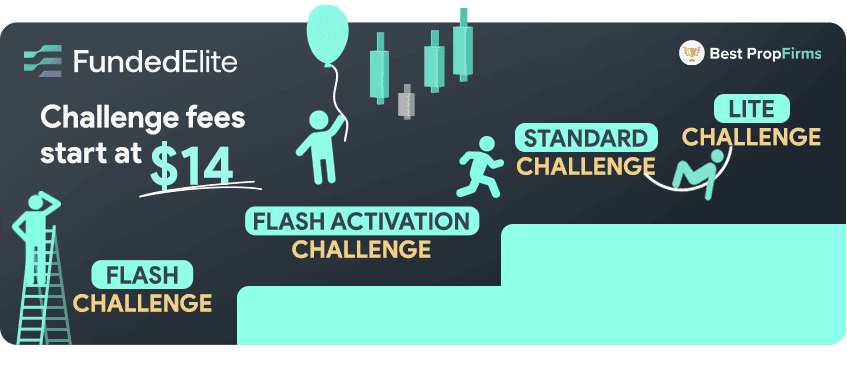

The standard challenge is a traditional two step evaluation process for MT5 and TradeLocker with static drawdown, fees starting from $41, and account sizes as low as $7K and large as $300K in which the profit targets for step one can be adjusted via the webpage while step two has a 5% target across the board towards a funded account.

The standard challenge is a traditional two step evaluation process for MT5 and TradeLocker with static drawdown, fees starting from $41, and account sizes as low as $7K and large as $300K in which the profit targets for step one can be adjusted via the webpage while step two has a 5% target across the board towards a funded account. The Lite Two Step Challenge has the same two-phase evaluation rules as the Standard Challenge with access to MT5 and TradeLocker, except it has a daily loss limit of 4% at a lower fee structure, and you won’t lose access to most trading conditions and rules. It’s designed to make it easier for beginner-friendly starting accounts with a lower purchase fee, but there is no second chance available for the Lite challenge.

The Lite Two Step Challenge has the same two-phase evaluation rules as the Standard Challenge with access to MT5 and TradeLocker, except it has a daily loss limit of 4% at a lower fee structure, and you won’t lose access to most trading conditions and rules. It’s designed to make it easier for beginner-friendly starting accounts with a lower purchase fee, but there is no second chance available for the Lite challenge. The Flash Challenge is the fastest evaluation model with only a live phase with stricter rules via MT5 and TradeLocker, a fixed daily loss limit of 3%, fixed 6% max loss limit, and it’s the only one with a trailing drawdown type. It’s suitable if you want to skip multi-step processes for quicker access to payouts

The Flash Challenge is the fastest evaluation model with only a live phase with stricter rules via MT5 and TradeLocker, a fixed daily loss limit of 3%, fixed 6% max loss limit, and it’s the only one with a trailing drawdown type. It’s suitable if you want to skip multi-step processes for quicker access to payouts The Flash Activation Challenge, also previously known as the Activation Challenge (Pay Later), is a fast adjustable evaluation model with a $5 fee to enter the 1-step evaluation, a 6% profit target, 3% static daily drawdown, 6% max drawdown, and no minimum trading days required.

The Flash Activation Challenge, also previously known as the Activation Challenge (Pay Later), is a fast adjustable evaluation model with a $5 fee to enter the 1-step evaluation, a 6% profit target, 3% static daily drawdown, 6% max drawdown, and no minimum trading days required. Funded Elite scores 8/10 in this category because it provides a wide range of evaluation models that are fully customizable with flexible account sizes, clear rules, free second chance options on selected accounts, and useful addons. The strict rules and floating loss enforcement, as well as the risk of fast breaches during news trading may not be suitable for most. But, there are only a few platforms who offer this type of flexibility in creating your own challenge requirements. In contrast to other prop firms like The Funded Trader, Funded Elite offers challenge diversity and clear rule structure, but requires careful risk management to avoid violations.

Funded Elite scores 8/10 in this category because it provides a wide range of evaluation models that are fully customizable with flexible account sizes, clear rules, free second chance options on selected accounts, and useful addons. The strict rules and floating loss enforcement, as well as the risk of fast breaches during news trading may not be suitable for most. But, there are only a few platforms who offer this type of flexibility in creating your own challenge requirements. In contrast to other prop firms like The Funded Trader, Funded Elite offers challenge diversity and clear rule structure, but requires careful risk management to avoid violations.

Funded Elite scores 7/10 for its raw-style spreads, simple commission structure, and cost-effective pricing on major pairs. The lack of commissions on indices, crypto, and equities helps keep overall trading costs predictable. Some instruments, especially niche CFDs and crypto pairs, can show wider spreads at off-peak times, but the core pricing remains competitive. Overall, Funded Elite offers a solid balance of tight spreads and transparent execution for most day-trading styles.

Funded Elite scores 7/10 for its raw-style spreads, simple commission structure, and cost-effective pricing on major pairs. The lack of commissions on indices, crypto, and equities helps keep overall trading costs predictable. Some instruments, especially niche CFDs and crypto pairs, can show wider spreads at off-peak times, but the core pricing remains competitive. Overall, Funded Elite offers a solid balance of tight spreads and transparent execution for most day-trading styles.

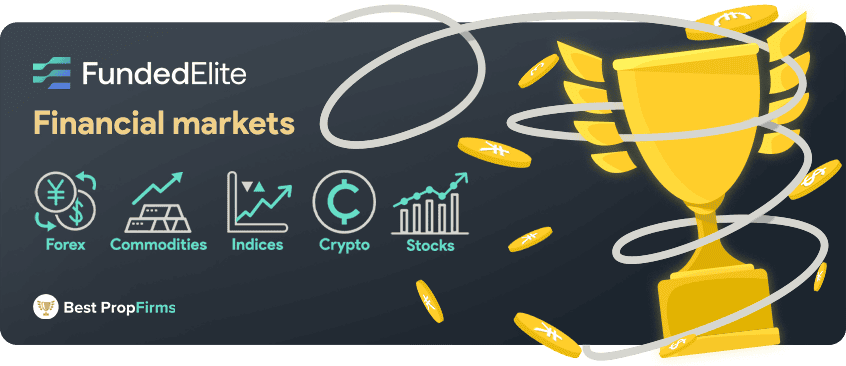

Funded Elite performs solidly in this category with a score of 7/10 due to its wide product range, realistic leverage settings, and flexible add ons that allow increased leverage on selected accounts. They have futures CFDs, crypto CFDs, metals, and global indices that improve market diversity. However, downsides include limited single stock selections and variable crypto availability. Compared to most prop firms, Funded Elite offers decent asset coverage and a competitive leverage structure.

Funded Elite performs solidly in this category with a score of 7/10 due to its wide product range, realistic leverage settings, and flexible add ons that allow increased leverage on selected accounts. They have futures CFDs, crypto CFDs, metals, and global indices that improve market diversity. However, downsides include limited single stock selections and variable crypto availability. Compared to most prop firms, Funded Elite offers decent asset coverage and a competitive leverage structure.

We give Funded Elite a score of 6 in this category due to its support for MT5, and TradeLocker, all of which cover major markets and tradable instruments. Automation is fully available on MT5, while TradeLocker provides a lightweight alternative. The lack of automation support on TradeLocker and platform restrictions reduce the score. Funded Elite offers restricted, but standard platform variety with reliable environments.

We give Funded Elite a score of 6 in this category due to its support for MT5, and TradeLocker, all of which cover major markets and tradable instruments. Automation is fully available on MT5, while TradeLocker provides a lightweight alternative. The lack of automation support on TradeLocker and platform restrictions reduce the score. Funded Elite offers restricted, but standard platform variety with reliable environments.

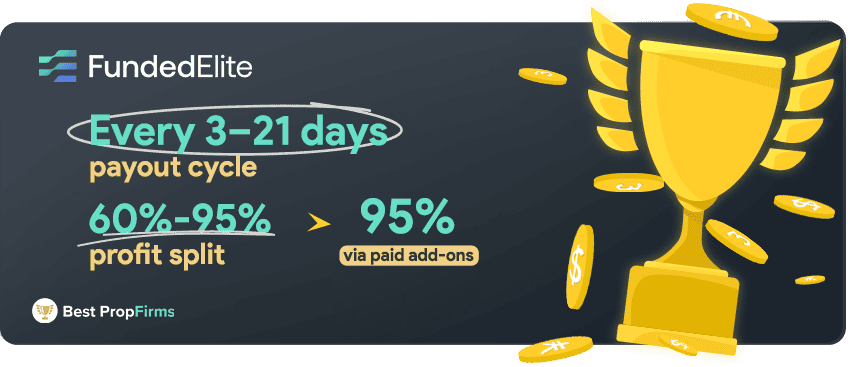

Funded Elite scores 4/10 due to its flexible profit split upgrades, and withdrawal method through Rise. The structured timing and transparent payout rules support predictable earnings once funded. However, a major downside is the major number of trader complaints in regards to non-existent payments, as well as strict risk controls on payout eligibility, and limitations for the timing structure of specific models.

Funded Elite scores 4/10 due to its flexible profit split upgrades, and withdrawal method through Rise. The structured timing and transparent payout rules support predictable earnings once funded. However, a major downside is the major number of trader complaints in regards to non-existent payments, as well as strict risk controls on payout eligibility, and limitations for the timing structure of specific models. Funded Elite scores 6/10 for its help center and multiple support channels. The documentation covers all key features, trading rules, and account types. Compared to other prop firms, Funded Elite offers fast tech-support, and clear rule explanations. However, the lack of courses, and interactive educational content reduced the score.

Funded Elite scores 6/10 for its help center and multiple support channels. The documentation covers all key features, trading rules, and account types. Compared to other prop firms, Funded Elite offers fast tech-support, and clear rule explanations. However, the lack of courses, and interactive educational content reduced the score.

Funded Elite scores a Goldilocks 5/10 score because of its clear public documentation, and transparent rule sets that are drastically lowered by their unfavorable reviews. In comparison to the newest prop firms, Funded Elite provides an open rule framework that reflects fair transparency, but the strict rule enforcement and country restrictions also negatively affect the score.

Funded Elite scores a Goldilocks 5/10 score because of its clear public documentation, and transparent rule sets that are drastically lowered by their unfavorable reviews. In comparison to the newest prop firms, Funded Elite provides an open rule framework that reflects fair transparency, but the strict rule enforcement and country restrictions also negatively affect the score.