Elite Trader Funding Review

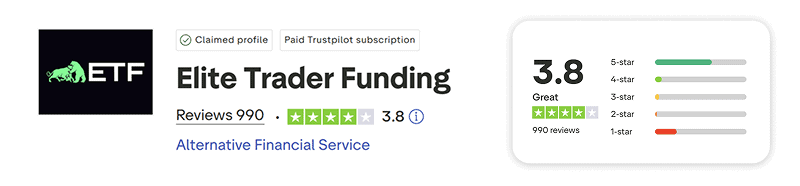

Elite Trader Funding is a US based futures prop firm that scored a low 47/100 during testing. It offers multiple evaluation models across major exchanges, but only provides real capital through an unclear and discretionary second phase.

DTF is their instant funding option that skips the evaluation entirely – you’re placed straight into a Sim-Funded account with a $10,000 payout cap. The drawdown is 10%, with no daily loss limit. Account sizes are limited to $25K and $50K, and once you hit the cap, you’re locked out for 30 days.

DTF is their instant funding option that skips the evaluation entirely – you’re placed straight into a Sim-Funded account with a $10,000 payout cap. The drawdown is 10%, with no daily loss limit. Account sizes are limited to $25K and $50K, and once you hit the cap, you’re locked out for 30 days. This is ETF’s most popular format with a one step evaluation. It uses an intraday trailing drawdown that moves with your open equity. There’s no daily loss limit. You can trade at your own pace with no time cap, and reset anytime for $75.

This is ETF’s most popular format with a one step evaluation. It uses an intraday trailing drawdown that moves with your open equity. There’s no daily loss limit. You can trade at your own pace with no time cap, and reset anytime for $75. EOD (End-of-Day) models apply a trailing drawdown based on your end-of-day balance, not live equity, which makes them less prone to mid-trade blowouts. There’s also a daily loss limit, calculated from the previous day’s close (e.g. 2.2%).

EOD (End-of-Day) models apply a trailing drawdown based on your end-of-day balance, not live equity, which makes them less prone to mid-trade blowouts. There’s also a daily loss limit, calculated from the previous day’s close (e.g. 2.2%). Fast Track accounts have the tightest timeline, just 14 calendar days to hit a 6% profit target with a trailing intraday drawdown. There’s no reset option, so if you fail, you have to buy a new one.

Fast Track accounts have the tightest timeline, just 14 calendar days to hit a 6% profit target with a trailing intraday drawdown. There’s no reset option, so if you fail, you have to buy a new one. Static accounts have fixed drawdowns that don’t move as your account grows. These are simple to manage: you know your absolute risk from day one.

Static accounts have fixed drawdowns that don’t move as your account grows. These are simple to manage: you know your absolute risk from day one. This is a special version of the EOD model with a few unique perks:

This is a special version of the EOD model with a few unique perks: