E8 Markets Review

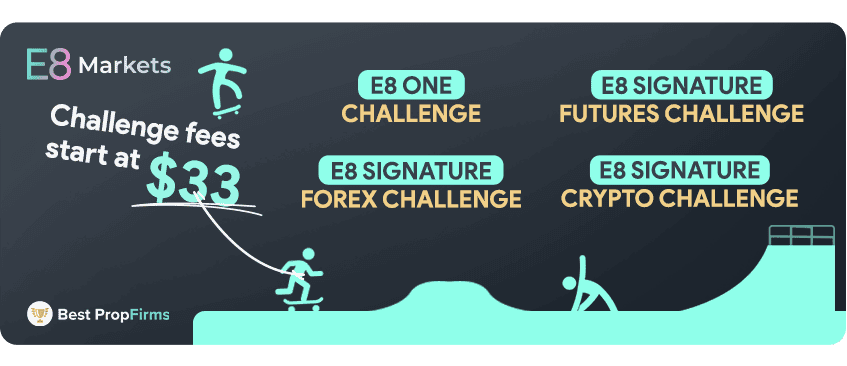

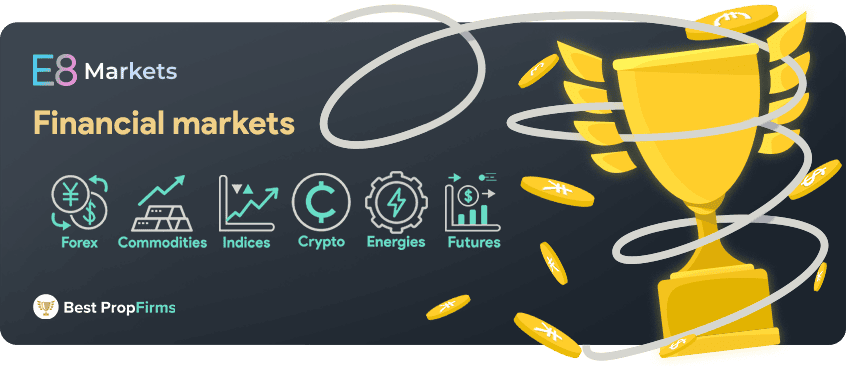

E8 Markets scores 64/100 in our review, placing it firmly in the mid tier of prop trading firms and not making any shortlists. It offers a wide range of markets and platforms across forex, futures, and crypto, but pairs that with strict risk controls and a complex payout processes.

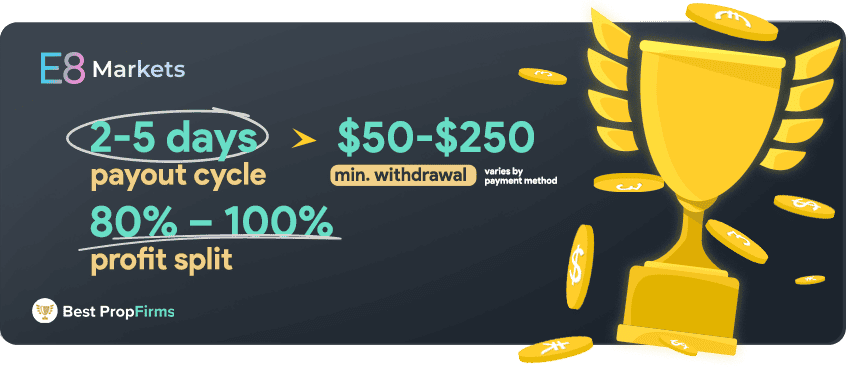

E8 One is the most flexible option, offering eight account sizes from $5k up to $500k with a configurable profit target that scales with your chosen drawdown, typically sitting around 8%. You can fully customise trailing drawdown choosing an amount between 4–14%, as well as payout splits with you can updgrade to 90% or 100%, from the default 80%, making it the most customisable account type.

E8 One is the most flexible option, offering eight account sizes from $5k up to $500k with a configurable profit target that scales with your chosen drawdown, typically sitting around 8%. You can fully customise trailing drawdown choosing an amount between 4–14%, as well as payout splits with you can updgrade to 90% or 100%, from the default 80%, making it the most customisable account type. Signature Forex keeps things simple with fixed $50k, $100k, and $150k accounts and a 6% profit target. The EOD trailing drawdown is softer than E8 One because it only updates once per day, but the no-overnight and no-weekend rule makes it a stricter model for swing traders.

Signature Forex keeps things simple with fixed $50k, $100k, and $150k accounts and a 6% profit target. The EOD trailing drawdown is softer than E8 One because it only updates once per day, but the no-overnight and no-weekend rule makes it a stricter model for swing traders. Signature Futures is the tightest model operationally, with fixed account sizes ($50k–$150k), an EOD trailing drawdown, and a 6% profit target. Positions auto-close at 15:10 CT and automation isn’t allowed, so this is a pure intraday futures challenge on CME products.

Signature Futures is the tightest model operationally, with fixed account sizes ($50k–$150k), an EOD trailing drawdown, and a 6% profit target. Positions auto-close at 15:10 CT and automation isn’t allowed, so this is a pure intraday futures challenge on CME products. Signature Crypto mirrors the Forex version with fixed $50k – $150k accounts, an EOD trailing drawdown, and a 6% profit target, but applies tighter leverage rules across altcoins. Overnight and weekend holding aren’t allowed, so it’s designed for active crypto day traders rather than swing or momentum strategies.

Signature Crypto mirrors the Forex version with fixed $50k – $150k accounts, an EOD trailing drawdown, and a 6% profit target, but applies tighter leverage rules across altcoins. Overnight and weekend holding aren’t allowed, so it’s designed for active crypto day traders rather than swing or momentum strategies.

E8 holds a 4.4/5 star TrustScore with around 3,000 reviews, which is strong compared to the industry average. Most ratings are favourable, with the majority of feedback describing smooth processes and reliable support.

E8 holds a 4.4/5 star TrustScore with around 3,000 reviews, which is strong compared to the industry average. Most ratings are favourable, with the majority of feedback describing smooth processes and reliable support.