What Are Prop Firm Evaluations?

Prop firm evaluations test traders on profitability and risk management before granting access to firm capital. Passing proves you can trade consistently while following strict rules, leading to a funded trading account.

Some prop firms offer rapid challenges, requiring traders to meet profit targets within a short timeframe, typically 7-10 days. These challenges test a trader’s ability to perform under pressure while managing risk.

Some prop firms offer rapid challenges, requiring traders to meet profit targets within a short timeframe, typically 7-10 days. These challenges test a trader’s ability to perform under pressure while managing risk. A one-step evaluation process requires traders to meet a profit target while following strict risk management rules. Unlike rapid challenges, this process focuses more on trading discipline than pure speed.

A one-step evaluation process requires traders to meet a profit target while following strict risk management rules. Unlike rapid challenges, this process focuses more on trading discipline than pure speed. The two-step evaluation process is the most common process used by prop firms. It allows traders to prove their skills over multiple phases, focusing on both profitability and risk control.

The two-step evaluation process is the most common process used by prop firms. It allows traders to prove their skills over multiple phases, focusing on both profitability and risk control. A three-step evaluation process is a less common but more rigorous assessment that extends the verification process further. This model ensures traders have a long-term, repeatable strategy before gaining access to a funded account.

A three-step evaluation process is a less common but more rigorous assessment that extends the verification process further. This model ensures traders have a long-term, repeatable strategy before gaining access to a funded account. Some prop firms offer instant funding, allowing traders to start with firm capital immediately without passing an evaluation. Instead of completing a challenge, traders pay a one-time fee to access a funded account with profit splits.

Some prop firms offer instant funding, allowing traders to start with firm capital immediately without passing an evaluation. Instead of completing a challenge, traders pay a one-time fee to access a funded account with profit splits.

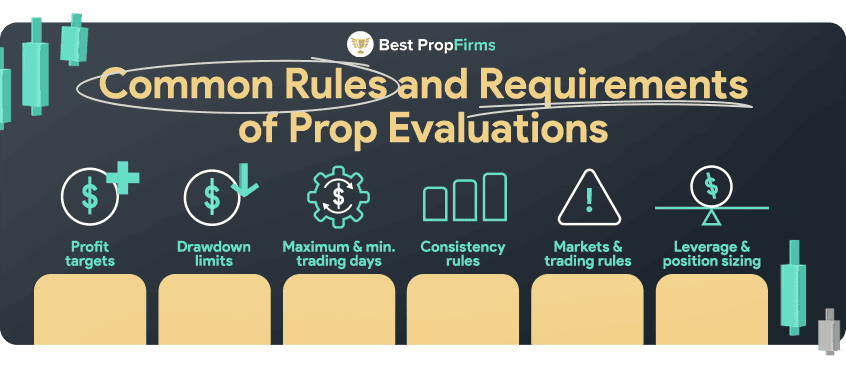

Profit targets are the minimum percentage or dollar amount a trader must achieve during the challenge. Most firms set targets between 5% and 10% of the starting balance.

Profit targets are the minimum percentage or dollar amount a trader must achieve during the challenge. Most firms set targets between 5% and 10% of the starting balance. Drawdown limits define the maximum amount a trader can lose before failing the evaluation. These limits ensure traders manage risk properly instead of chasing profits recklessly.

Drawdown limits define the maximum amount a trader can lose before failing the evaluation. These limits ensure traders manage risk properly instead of chasing profits recklessly. Prop firms set time constraints to balance risk and prevent traders from either rushing trades or dragging out the evaluation process indefinitely.

Prop firms set time constraints to balance risk and prevent traders from either rushing trades or dragging out the evaluation process indefinitely. To prevent traders from passing the evaluation with a single high-risk trade, many firms impose consistency requirements:

To prevent traders from passing the evaluation with a single high-risk trade, many firms impose consistency requirements: Proprietary trading firms control which financial instruments you can trade and what trading strategies you can use to prevent excessive risk.

Proprietary trading firms control which financial instruments you can trade and what trading strategies you can use to prevent excessive risk. Prop trading firms often limit leverage and trade size to prevent traders from taking excessive risks.

Prop trading firms often limit leverage and trade size to prevent traders from taking excessive risks.

Prop firm challenges are worth it for traders with strong risk management skills, well-defined strategies, and consistent trading performance. Passing an evaluation grants access to larger trading capital with profit splits ranging from 70% to 90%.

Prop firm challenges are worth it for traders with strong risk management skills, well-defined strategies, and consistent trading performance. Passing an evaluation grants access to larger trading capital with profit splits ranging from 70% to 90%.