Best Stock Trading Prop Firms

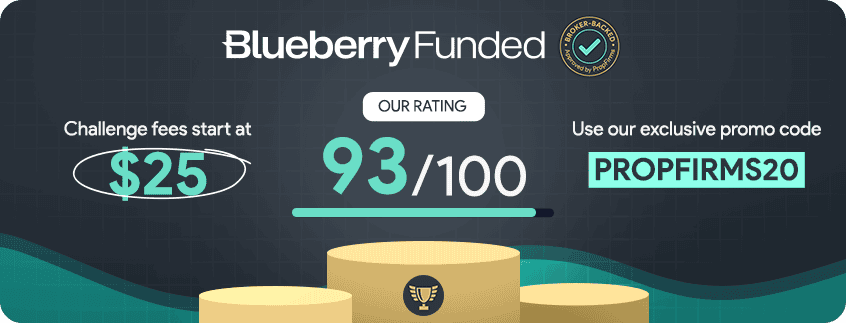

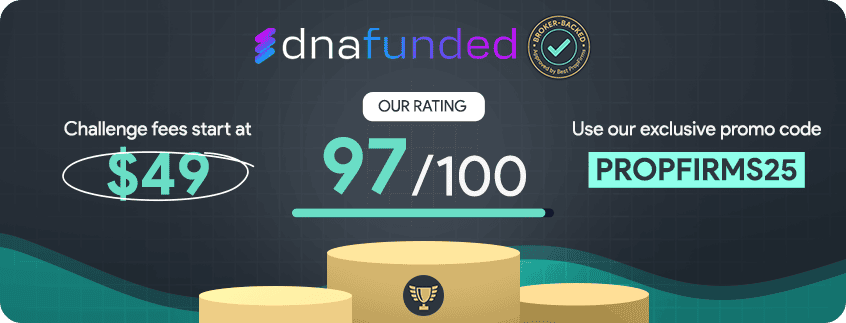

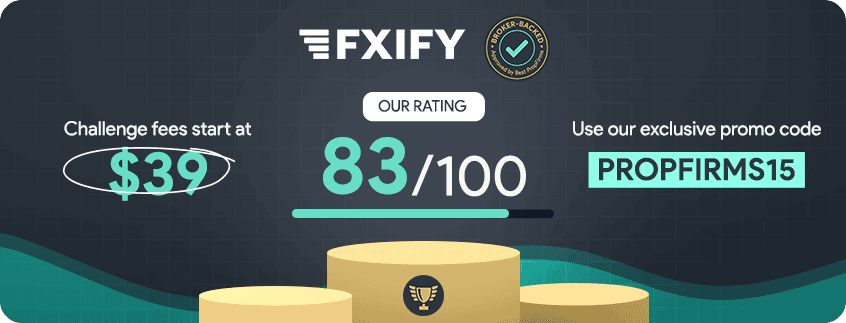

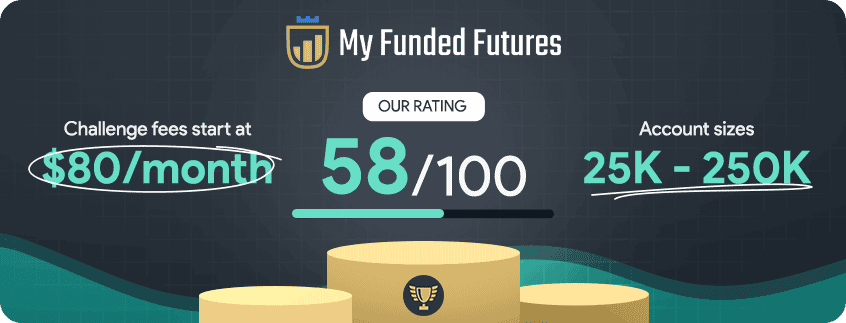

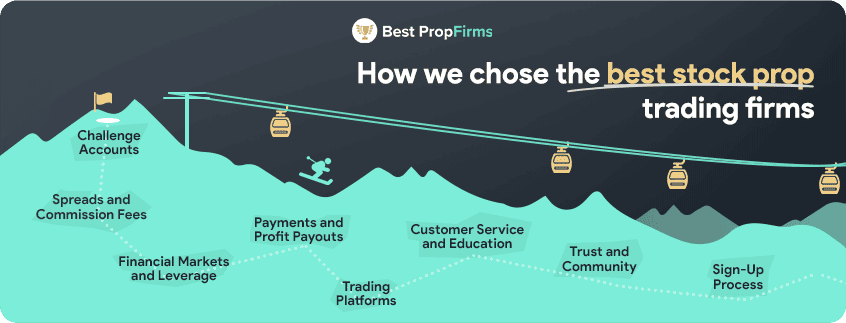

Find the best stock prop firms offering access to global equity markets, competitive profit splits, and the best evaluation processes. Our guide compares challenges where shares are available to trade, based on important features like fees, platforms, and funded account rules to help you compare the best prop firms for stock markets.

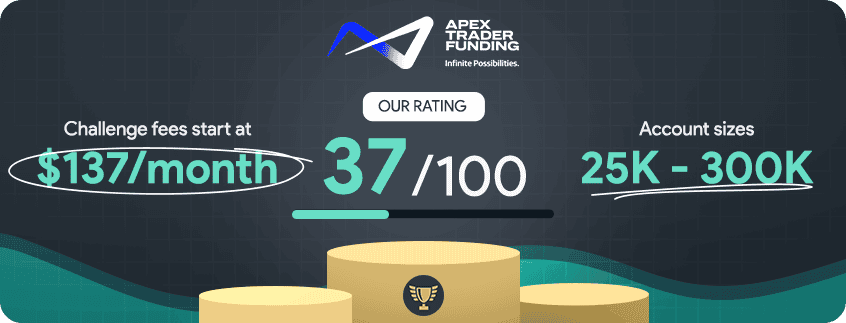

A stock prop firm, or stock proprietary trading firm, provides traders with access to institutional-level capital for trading stocks. Traders are typically evaluated through a structured process—such as single or multi-phase challenges—where they must meet specific profit targets and adhere to risk management rules. Once funded, traders share profits with the firm, with profit splits ranging from 70% to 100%, depending on the firm and account type.

A stock prop firm, or stock proprietary trading firm, provides traders with access to institutional-level capital for trading stocks. Traders are typically evaluated through a structured process—such as single or multi-phase challenges—where they must meet specific profit targets and adhere to risk management rules. Once funded, traders share profits with the firm, with profit splits ranging from 70% to 100%, depending on the firm and account type.