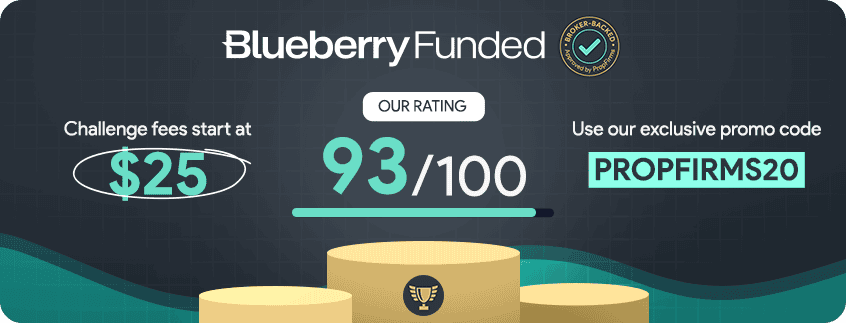

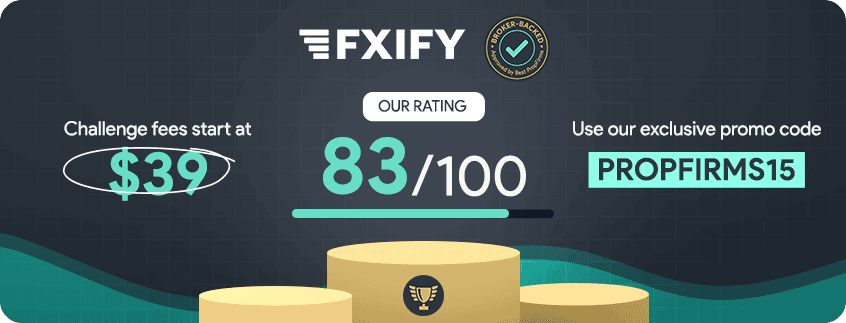

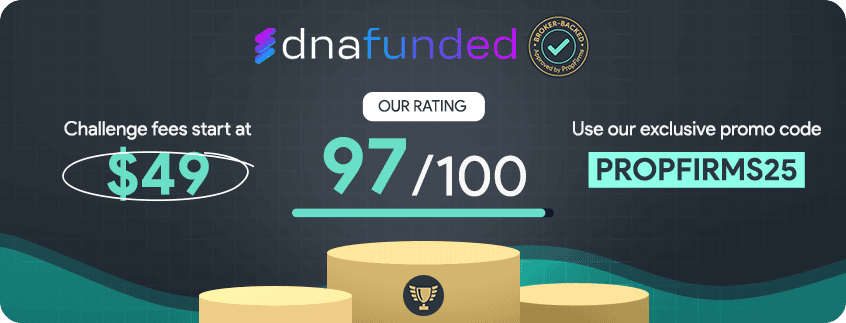

Best Instant Funding Prop Firms (Verified Testing 2026)

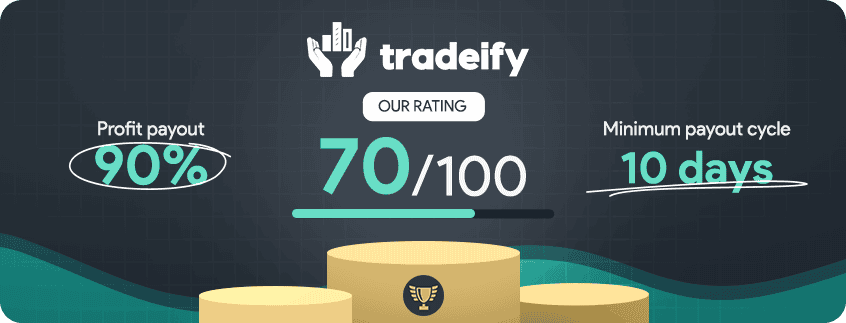

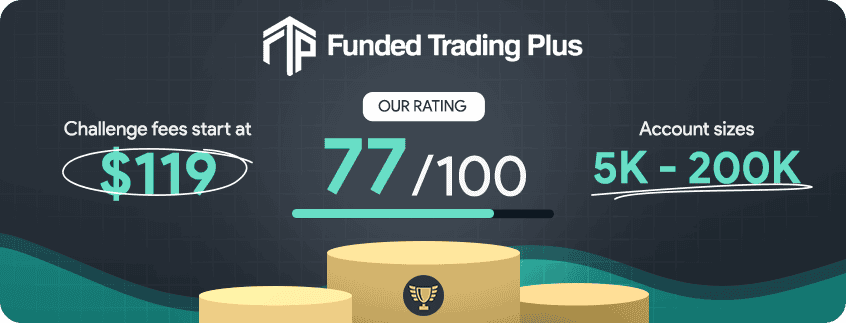

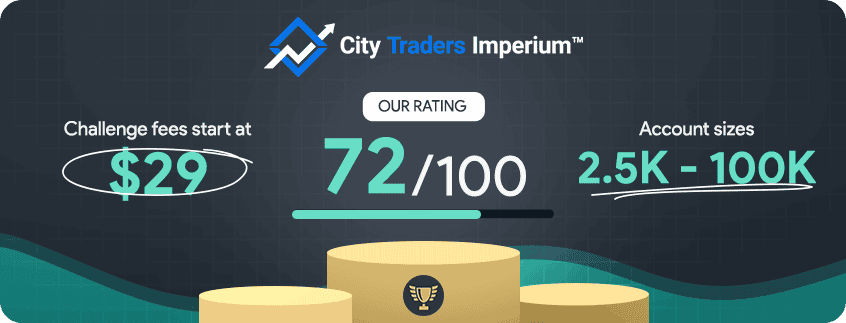

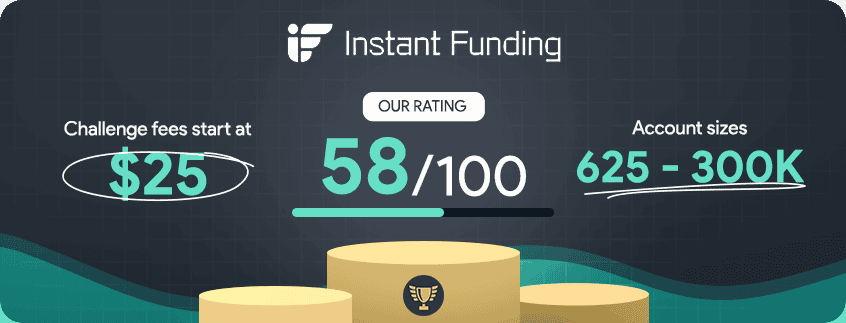

Find the best instant funding prop firms offering immediate access to trading accounts and capital. This guide breaks down true instant funding account options only, along with their platforms, fees, profit payouts and more, to help you choose the ideal funded account and prop firm.

Ask an Expert