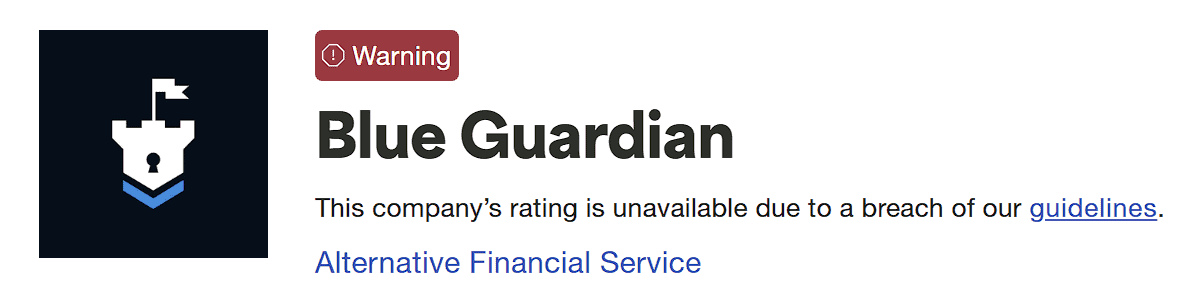

Blue Guardian Review

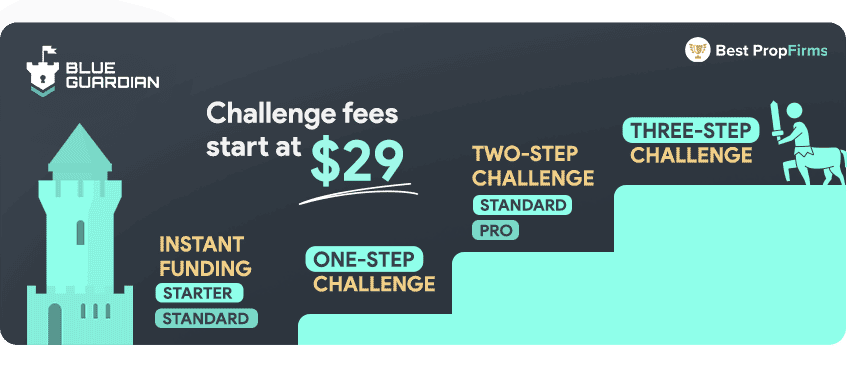

Blue Guardian scored just 45/100 due to unclear rules, capped payouts, and inconsistent account models. While it offers instant and multi-step evaluations, key terms vary across plans, making it harder to judge long-term value. If you’re considering this firm, read each model carefully, some accounts carry limits that may not suit active or experienced traders.

This is a single-use option that gives you a $5,000 funded account upfront with no profit target. There’s no evaluation phase, but payouts are capped, you can only withdraw once, and the maximum payout is $250 (5% of the starting balance). Once that withdrawal is made, the account is closed permanently.

This is a single-use option that gives you a $5,000 funded account upfront with no profit target. There’s no evaluation phase, but payouts are capped, you can only withdraw once, and the maximum payout is $250 (5% of the starting balance). Once that withdrawal is made, the account is closed permanently. This model gives you immediate access to funded capital across six account sizes, from $5,000 to $200,000. There’s no profit target to hit, but you’ll need to trade within a 3% daily and 5% max trailing drawdown.

This model gives you immediate access to funded capital across six account sizes, from $5,000 to $200,000. There’s no profit target to hit, but you’ll need to trade within a 3% daily and 5% max trailing drawdown. This is a single-phase evaluation with no deadlines. Once you hit the profit target, you’re eligible for a funded account. Risk rules use static drawdowns: 3% daily and 6% total. All accounts under this model include a refundable fee, which is returned after your fourth successful payout.

This is a single-phase evaluation with no deadlines. Once you hit the profit target, you’re eligible for a funded account. Risk rules use static drawdowns: 3% daily and 6% total. All accounts under this model include a refundable fee, which is returned after your fourth successful payout. The Two Step Standard is a classic evaluation model with no time limits. You need to complete two phases before becoming funded: the first has a 10% profit target, the second requires 5%.

The Two Step Standard is a classic evaluation model with no time limits. You need to complete two phases before becoming funded: the first has a 10% profit target, the second requires 5%. The Pro version uses a three-phase structure, but still includes “Two Step” in the name. Step 1 and 2 are challenges, followed by Step 3 as the funded phase. Each challenge has the same 8% total and 4% daily drawdowns.

The Pro version uses a three-phase structure, but still includes “Two Step” in the name. Step 1 and 2 are challenges, followed by Step 3 as the funded phase. Each challenge has the same 8% total and 4% daily drawdowns. The Three Step Evaluation is Blue Guardian’s most accessible challenge, designed for traders who want a lower-cost entry point and are comfortable progressing through multiple stages. It includes three stages: Step 1, Step 2, and the Guardian Trader phase.

The Three Step Evaluation is Blue Guardian’s most accessible challenge, designed for traders who want a lower-cost entry point and are comfortable progressing through multiple stages. It includes three stages: Step 1, Step 2, and the Guardian Trader phase.