Our Methodology In 2026

We help traders find the best prop firms by comparing features, trade costs, and execution speeds. Our rankings focus on profit payouts, account costs, leverage, and funding steps, with regular updates and thorough platform testing by our research team.

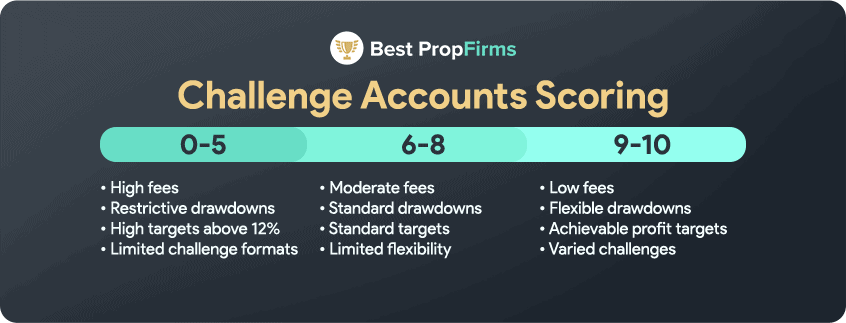

In our methodology, each prop trading firm is evaluated on its approach to onboarding and challenge structures, as these processes often reveal the firm’s transparency, accessibility, and fairness in funding.

In our methodology, each prop trading firm is evaluated on its approach to onboarding and challenge structures, as these processes often reveal the firm’s transparency, accessibility, and fairness in funding.

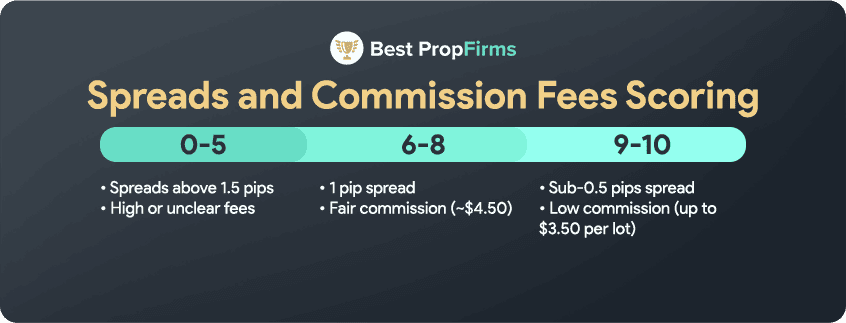

Spreads and commission fees are crucial for maintaining profitability, especially in high-frequency trading.

Spreads and commission fees are crucial for maintaining profitability, especially in high-frequency trading.

A diverse market selection and appropriate leverage give traders more flexibility in strategies. We look for firms that offer a broad range of financial markets, from forex and indices to commodities and crypto.

A diverse market selection and appropriate leverage give traders more flexibility in strategies. We look for firms that offer a broad range of financial markets, from forex and indices to commodities and crypto.

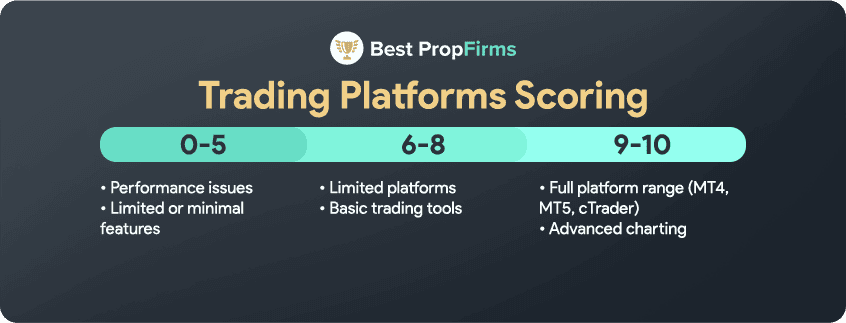

Platforms play a key role in traders’ experience, so we assess firms based on the quality and versatility of their trading platforms. Firms that offer multiple platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or TradingView score higher, especially if they come with advanced tools, high performance, and mobile accessibility.

Platforms play a key role in traders’ experience, so we assess firms based on the quality and versatility of their trading platforms. Firms that offer multiple platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or TradingView score higher, especially if they come with advanced tools, high performance, and mobile accessibility.

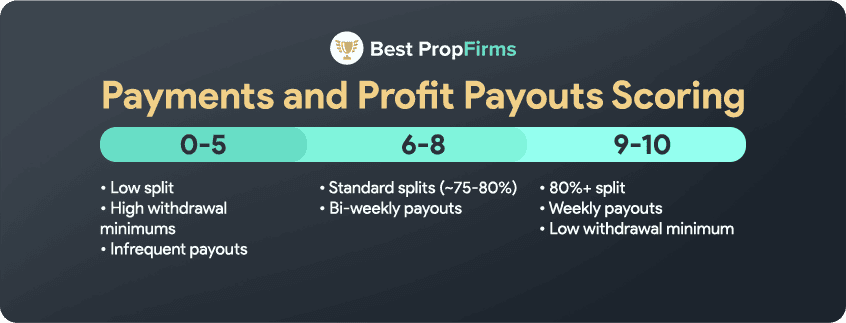

Profit payouts are essential for traders looking to access earnings without delay. Firms are scored on payout frequency, minimum withdrawal amounts, and profit split percentages. Firms offering low minimums, higher splits, and fast payout cycles earn higher marks for supporting trader cash flow and flexibility.

Profit payouts are essential for traders looking to access earnings without delay. Firms are scored on payout frequency, minimum withdrawal amounts, and profit split percentages. Firms offering low minimums, higher splits, and fast payout cycles earn higher marks for supporting trader cash flow and flexibility.

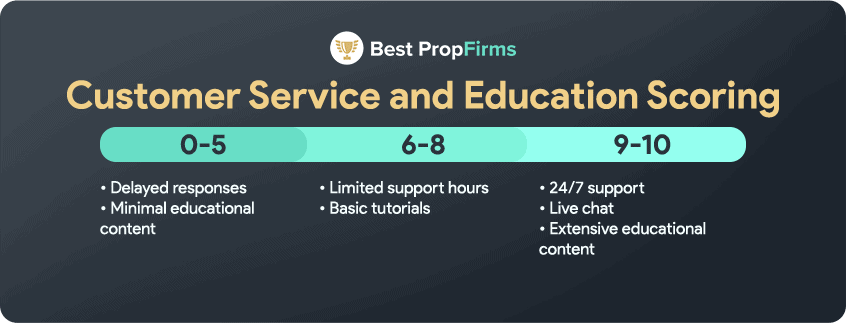

A prop firm’s support and educational resources are vital for a positive trading experience.

A prop firm’s support and educational resources are vital for a positive trading experience.

Trust and community engagement reflect a firm’s reliability and openness. We consider reviews on platforms like Trustpilot, the transparency of fees and policies, and the presence of active communities (e.g., Discord).

Trust and community engagement reflect a firm’s reliability and openness. We consider reviews on platforms like Trustpilot, the transparency of fees and policies, and the presence of active communities (e.g., Discord).

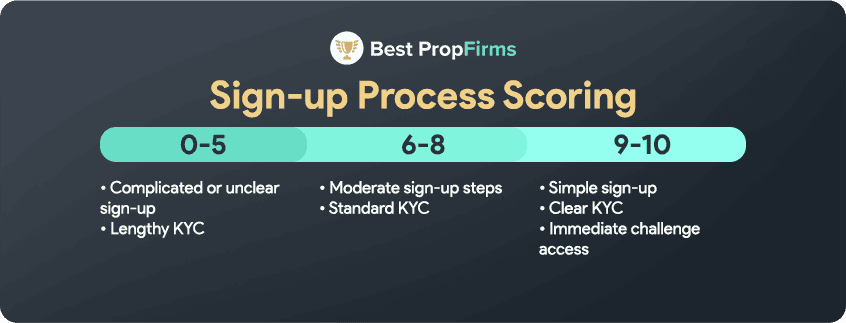

A straightforward, quick sign-up process is essential for a smooth onboarding experience. Firms that offer simple, secure sign-up forms and immediate access to evaluation challenges score highly. Clear KYC requirements and guidance on the onboarding process also add to the score.

A straightforward, quick sign-up process is essential for a smooth onboarding experience. Firms that offer simple, secure sign-up forms and immediate access to evaluation challenges score highly. Clear KYC requirements and guidance on the onboarding process also add to the score.