Risk Management in Prop Trading

Risk management in prop trading is key to staying funded and avoiding major losses. Prop firms set strict trading rules like drawdown limits and stop-loss requirements to protect their capital and keep traders disciplined. Before you start trading, its important to have a solid risk management strategy, to build long-term consistency and reduce the risk of blowing your account on a few bad trades.

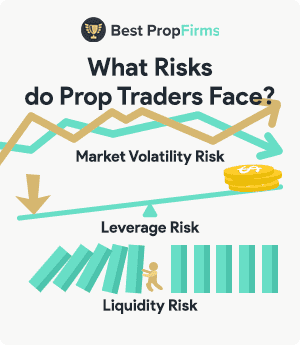

Prop traders face various types of risk, including market volatility, leverage, and liquidity risk. Market volatility can cause sudden price swings, potentially leading to larger losses if trades move against the trader’s position.

Prop traders face various types of risk, including market volatility, leverage, and liquidity risk. Market volatility can cause sudden price swings, potentially leading to larger losses if trades move against the trader’s position.