How to Get Into Prop Trading

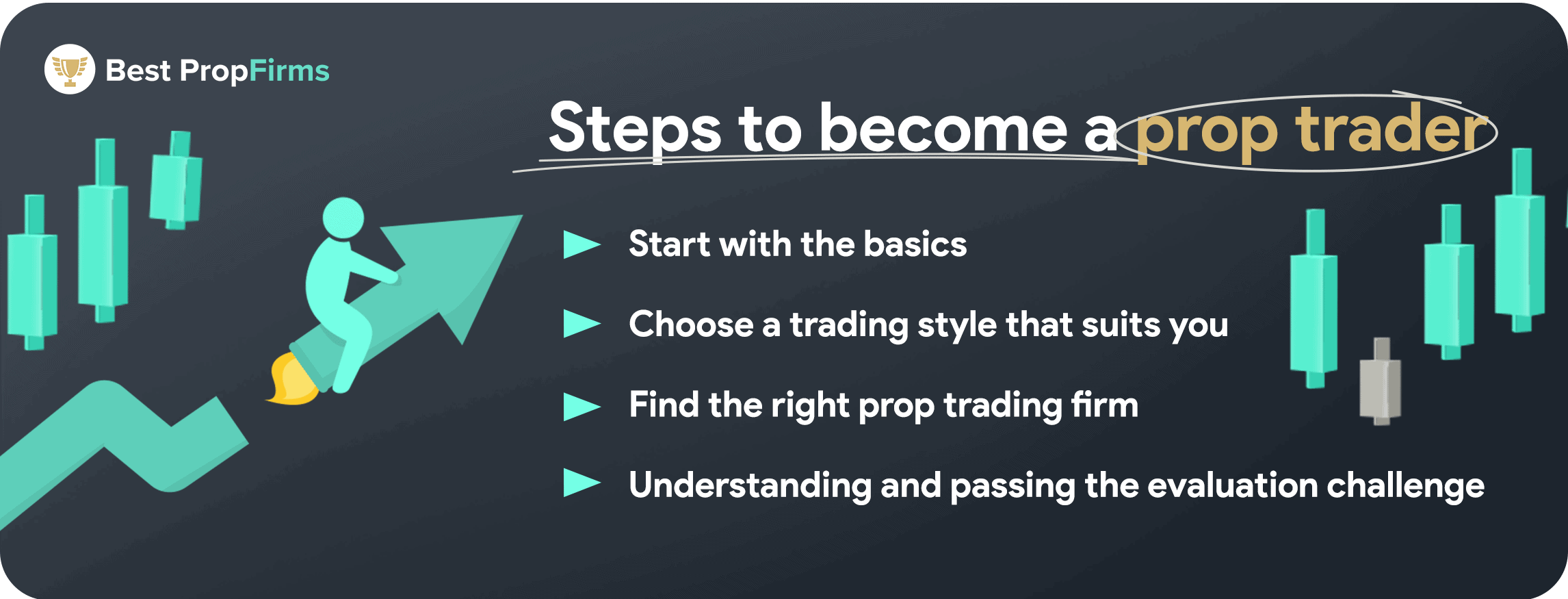

To get into prop trading, begin by joining a prop firm, passing their evaluation, and honing your risk management skills. This lets you trade with the firm’s funds, giving you market access and a share of profits. Our guide outlines each step, from selecting the right firm to building a trading career.