How Do Prop Firms Make Money?

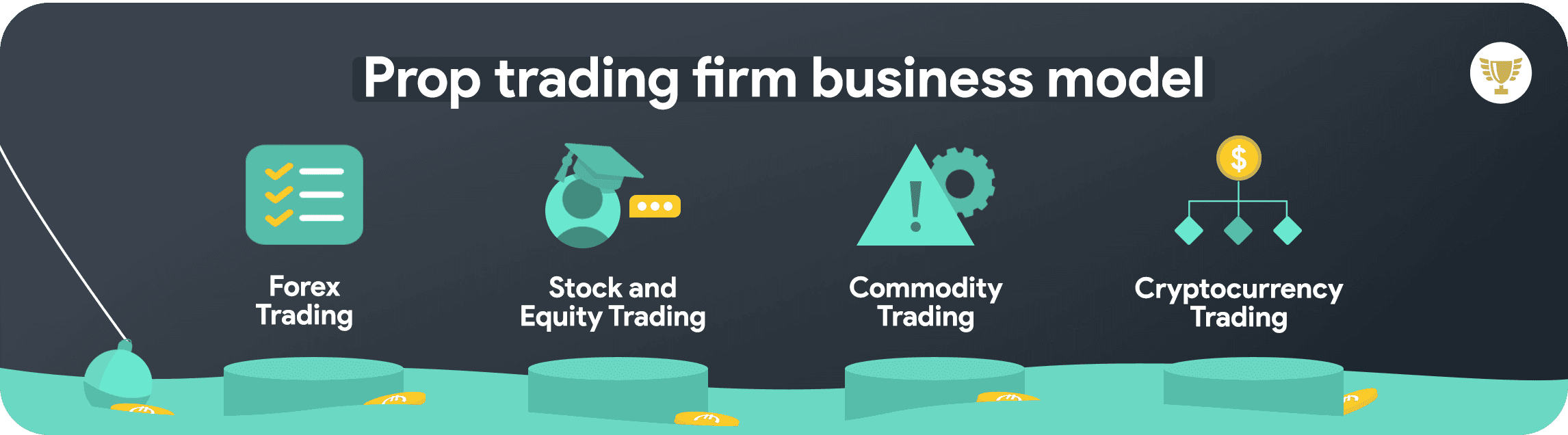

Prop trading firms make money by sharing profits from funded trades and earning fees from evaluations and educational services. With strict risk management rules and trading support in place, they create a setup where both the prop firm and traders can benefit from successful trading.

A significant part of a prop firm’s income comes from profit-sharing agreements with prop traders. These splits, based on the capital provided, are a key attraction of prop firms which allows traders access to larger trading capital.

A significant part of a prop firm’s income comes from profit-sharing agreements with prop traders. These splits, based on the capital provided, are a key attraction of prop firms which allows traders access to larger trading capital.

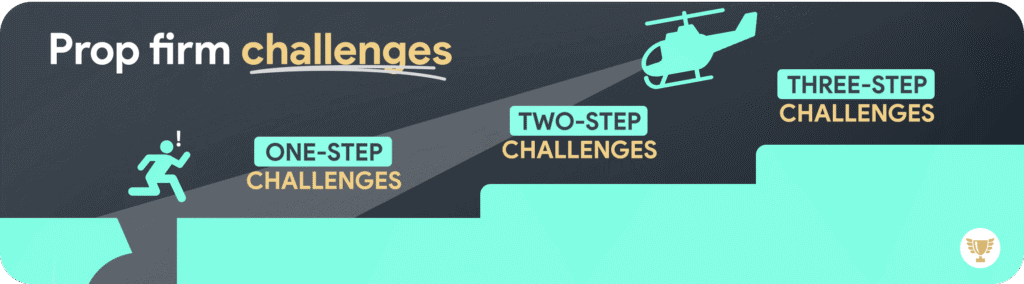

The evaluation process serves as both a screening tool and a revenue source for prop firms, and this provides steady income to the firm so they can cover operational costs.

The evaluation process serves as both a screening tool and a revenue source for prop firms, and this provides steady income to the firm so they can cover operational costs.

The disadvantages of prop firms include high evaluation fees, strict trading rules, and the risk of losing access to funding if you break critical rules. Traders often face the difficulty to meet profit targets within tight timeframes, and this pressures even the most talented traders to make rushed decisions.

The disadvantages of prop firms include high evaluation fees, strict trading rules, and the risk of losing access to funding if you break critical rules. Traders often face the difficulty to meet profit targets within tight timeframes, and this pressures even the most talented traders to make rushed decisions.