How Prop Trading Challenges Work

Prop firms fund skilled and disciplined traders, giving them significant capital to trade with, rather than their own money, and sharing profits in return. To qualify, you must pass a challenge proving you can trade successfully within strict risk limits, achieve profit targets, and staying within the prop firm’s rules. This model helps you scale without risking personal funds, while allowing firms to profit from those who can consistently generate profits.

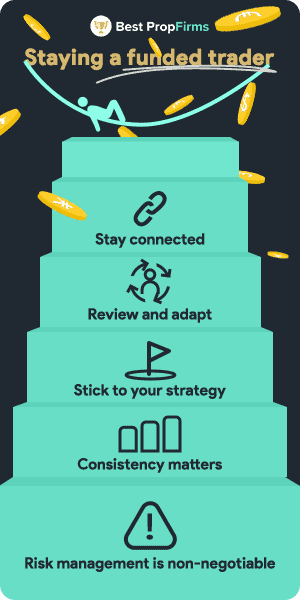

No matter how skilled or profitable you are, ignoring risk limits will get you disqualified. Daily and overall loss caps exist for a reason, and once you cross them, your account is gone. Staying funded means treating risk management as the base of everything you do.

No matter how skilled or profitable you are, ignoring risk limits will get you disqualified. Daily and overall loss caps exist for a reason, and once you cross them, your account is gone. Staying funded means treating risk management as the base of everything you do.