What is Crypto Prop Trading?

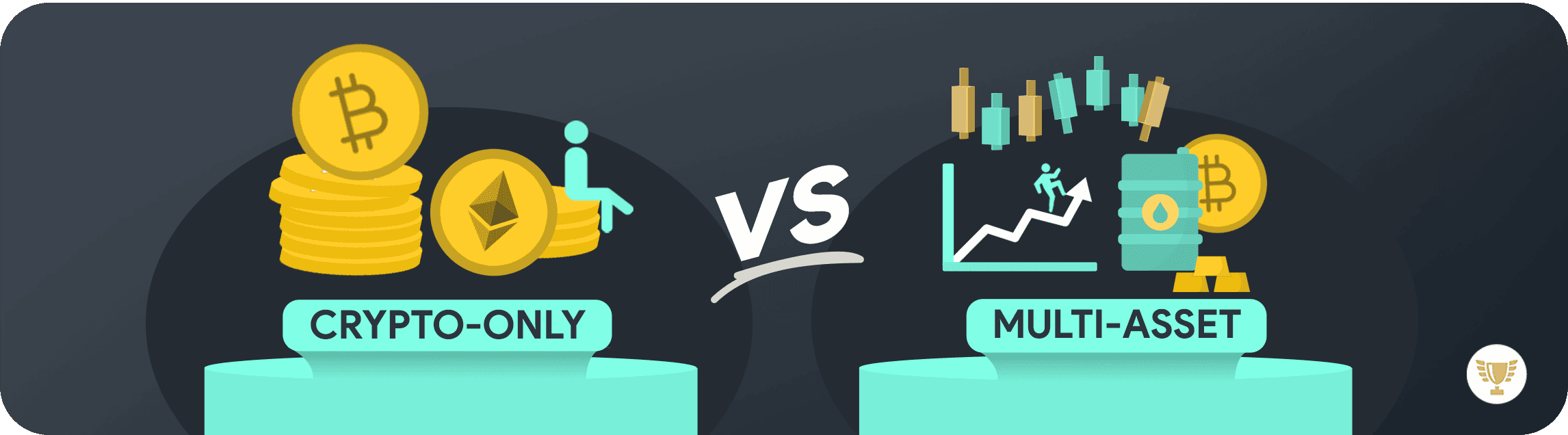

Crypto prop trading gives skilled traders access to firm-funded capital to trade digital assets like Bitcoin, Ethereum, and altcoins. Instead of using your own money, you trade with the crypto prop firm’s capital and share a portion of the profits, often keeping 70% or more.

BrightFunded is the leading crypto prop firm, offering high leverage, over 40 crypto pairs, and scalable funded accounts. With profit splits reaching up to 100%, it provides a strong option for traders aiming to grow their accounts and maximize returns.

BrightFunded is the leading crypto prop firm, offering high leverage, over 40 crypto pairs, and scalable funded accounts. With profit splits reaching up to 100%, it provides a strong option for traders aiming to grow their accounts and maximize returns. Tailored for crypto traders, this prop firm provides institutional-grade pricing and flexible challenge options made possible by being backed by DNA Markets.

Tailored for crypto traders, this prop firm provides institutional-grade pricing and flexible challenge options made possible by being backed by DNA Markets. The availability of class-leading profit splits of up to 95%, no commissions for trading cryptocurrencies, and strong support for algorithmic trading strategies make them stand out in crypto prop trading.

The availability of class-leading profit splits of up to 95%, no commissions for trading cryptocurrencies, and strong support for algorithmic trading strategies make them stand out in crypto prop trading. Blueberry Funded offers the widest range of crypto instruments available to trade. Comes with a quick 7-day challenge, consistent scaling program, EA trading support, and stable trading conditions are all factors traders are looking for, making them a top contender.

Blueberry Funded offers the widest range of crypto instruments available to trade. Comes with a quick 7-day challenge, consistent scaling program, EA trading support, and stable trading conditions are all factors traders are looking for, making them a top contender.

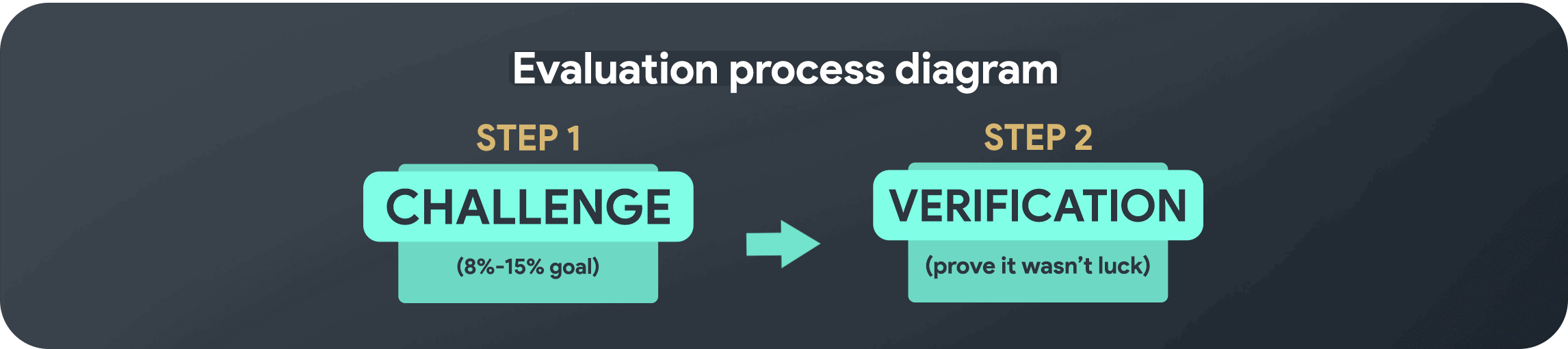

Before you start prop trading and purchase a challenge, it’s vital to evaluate the evaluation process, or you are risking wasting time and money

Before you start prop trading and purchase a challenge, it’s vital to evaluate the evaluation process, or you are risking wasting time and money