Prop Trading Account Types

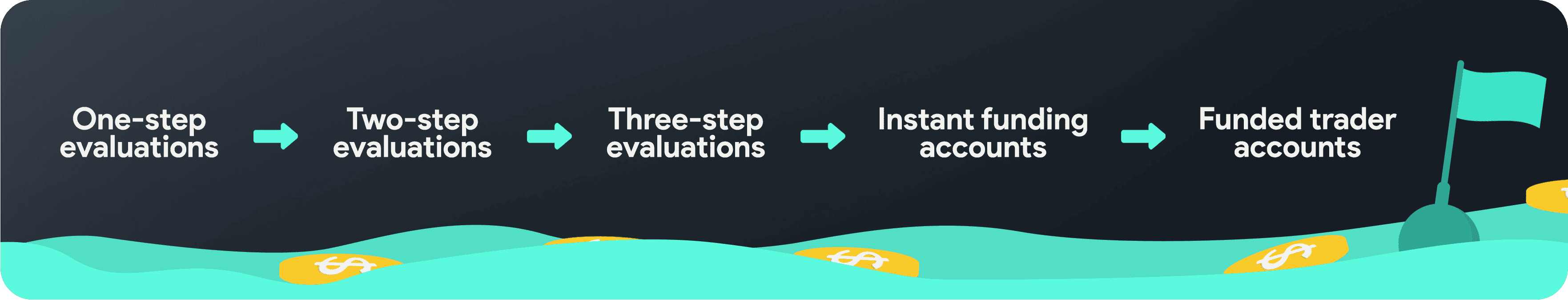

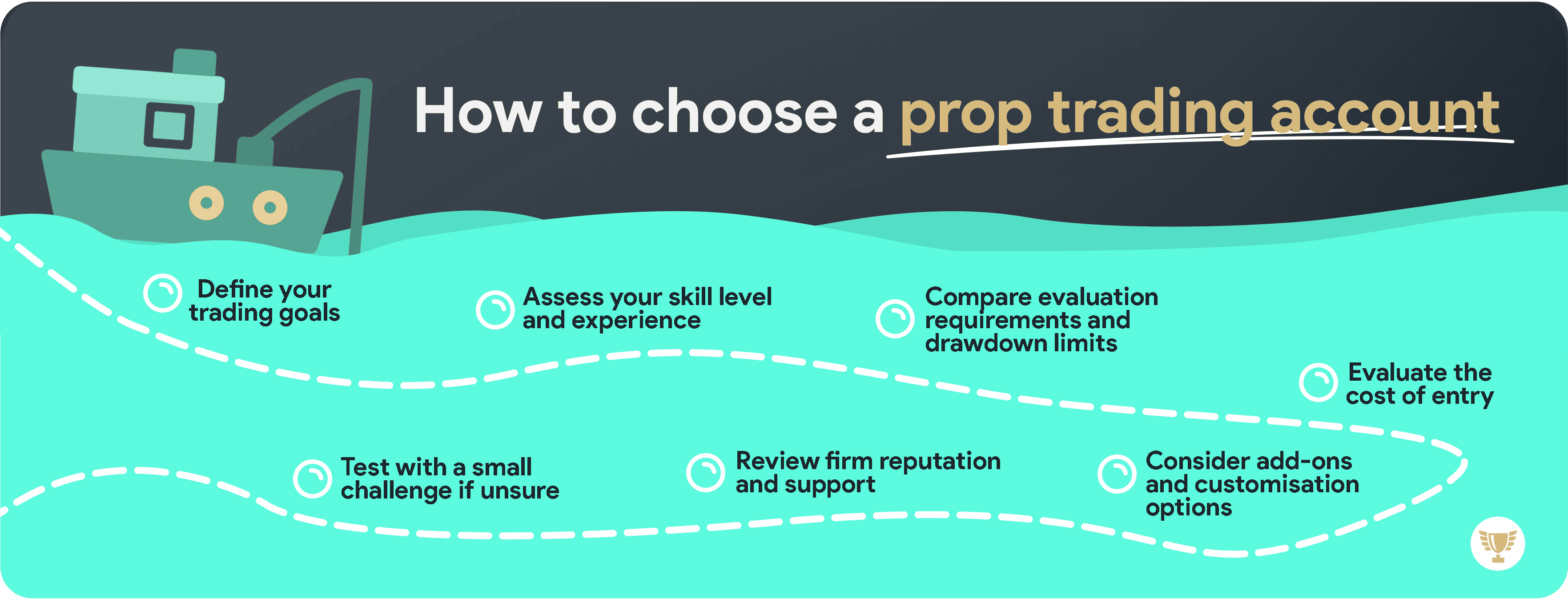

Prop trading firms give traders access to capital without risking personal funds. Account types vary, from quick one-step challenges to multi-step evaluations and instant funding options. This guide covers each type, helping you find the right pathway to a funded account.