Best Crypto Prop Firms

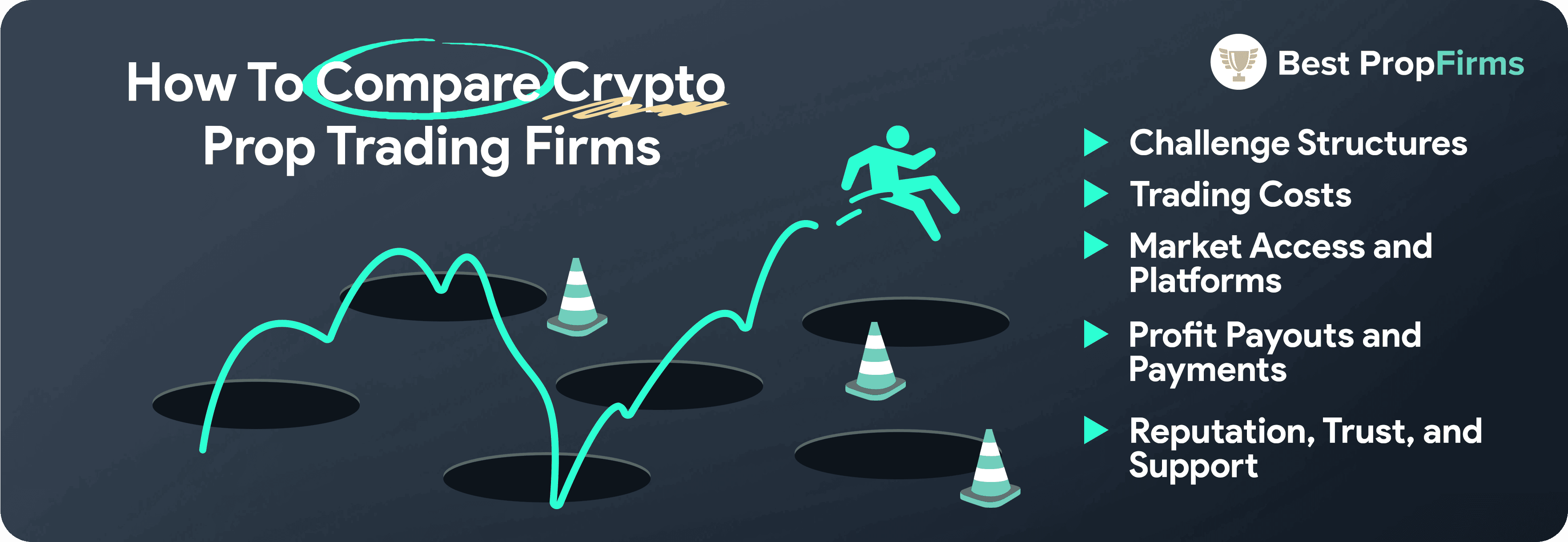

We’ve shortlisted the 10 best crypto prop firms, comparing key features like challenge types, audition fees, financial instruments, and trading costs. Our guide will help you find the prop firm and challenge best suited to your cryptocurrency trading style.

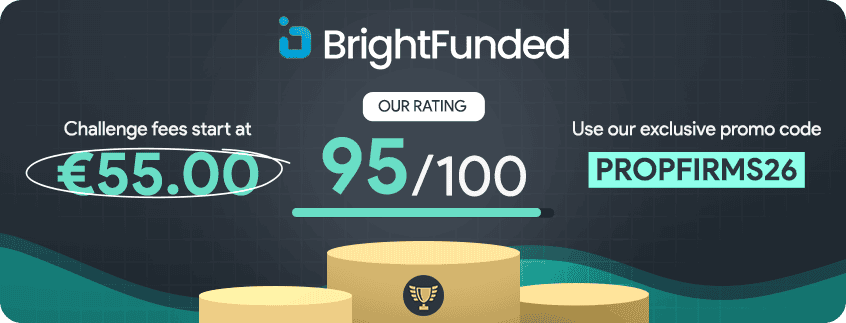

BrightFunded is a top choice for crypto traders, with 40+ cryptocurrency pairs, profit splits up to 100%, and customizable add-ons to boost your trading conditions. You also get 5:1 leverage on crypto, which is higher than most prop firms offer.

BrightFunded is a top choice for crypto traders, with 40+ cryptocurrency pairs, profit splits up to 100%, and customizable add-ons to boost your trading conditions. You also get 5:1 leverage on crypto, which is higher than most prop firms offer.

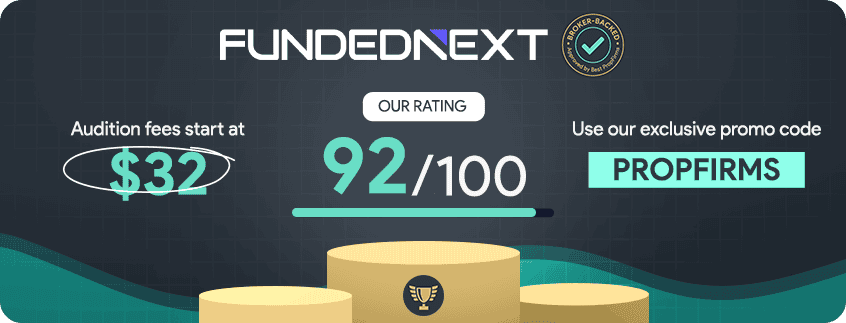

FundedNext is a great option if you want zero-commission crypto trading, profit splits up to 95%, and access to multiple trading platforms like MT4, MT5, and cTrader. Payouts are processed every two weeks, keeping withdrawals consistent.

FundedNext is a great option if you want zero-commission crypto trading, profit splits up to 95%, and access to multiple trading platforms like MT4, MT5, and cTrader. Payouts are processed every two weeks, keeping withdrawals consistent.

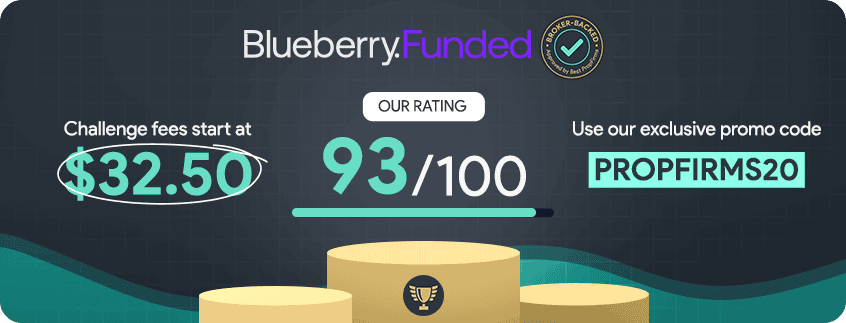

Blueberry Funded is a strong option if you want EA-friendly crypto trading with 24/7 access and low fees starting from $32.50. With four challenge types and support for 52 crypto markets, you can choose between structured or rapid evaluations to match your trading pace.

Blueberry Funded is a strong option if you want EA-friendly crypto trading with 24/7 access and low fees starting from $32.50. With four challenge types and support for 52 crypto markets, you can choose between structured or rapid evaluations to match your trading pace.