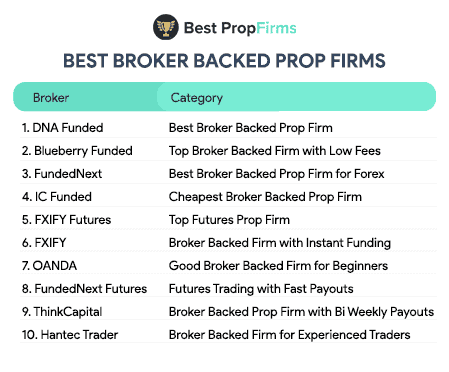

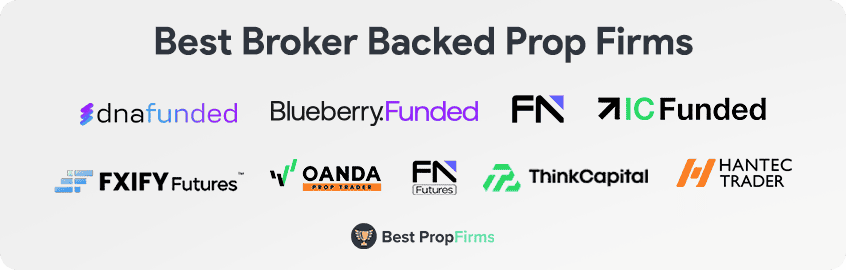

Best Broker Backed Prop Firms

Explore our list of the top broker-backed prop firms, offering large funded accounts, clear trading rules, and flexible profit-sharing options. These firms are partnered with regulated brokers to provide a secure and trusted trading experience.

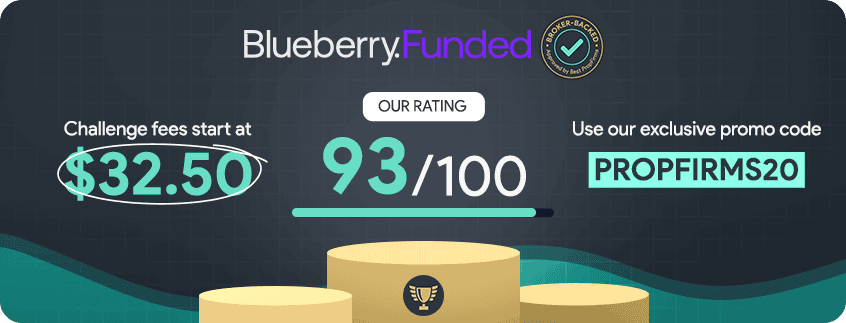

Blueberry Funded is the 2nd best broker backed prop firm on our list, thanks to its ultra-low fees starting from $32.50, access to over 1,100+ markets, and new support for stock prop trading. It’s backed by Blueberry Markets, an ASIC-regulated broker, and offers four challenge types, a scaling plan up to $2 million, and profit splits up to 90%. With raw spreads from 0.1 pips, it’s ideal for traders seeking low-cost access to funded accounts.

Blueberry Funded is the 2nd best broker backed prop firm on our list, thanks to its ultra-low fees starting from $32.50, access to over 1,100+ markets, and new support for stock prop trading. It’s backed by Blueberry Markets, an ASIC-regulated broker, and offers four challenge types, a scaling plan up to $2 million, and profit splits up to 90%. With raw spreads from 0.1 pips, it’s ideal for traders seeking low-cost access to funded accounts.

Here’s how we assess each firm:

Here’s how we assess each firm:

Ask an Expert